More importantly those who should know, the ever-increasing number of ‘China experts’, claim that the growing middle class in China and other countries, like Indonesia, will be able to afford, pretty much at any price, what we produce and there are already several precedents that indicate that could be true. Milk as we shall see, Wagyu beef, premium wine and so on.

I don’t think Australia stands a chance when it comes to developing a bigger business in China or anywhere else. I think we will fiddle around the edges, make big of little things. The reasons for my pessimism are:

- Productivity in Australia is going down. Costs are going up. We continue to fight among ourselves we refuse to become organised and speak with one voice.

- Farmers are suspicious of everyone looking at agriculture with new eyes, especially if they are foreign and have money.

- Farmers (generally) are heavily in debt so they believe, and they haven’t been told any different, that their potential to change and repay those debts in the short term so that change can happen, is limited. How to reduce crop and increase sheep for instance. Where will the money come from? Are the banks in favour of change? Will change affect the value of the land?

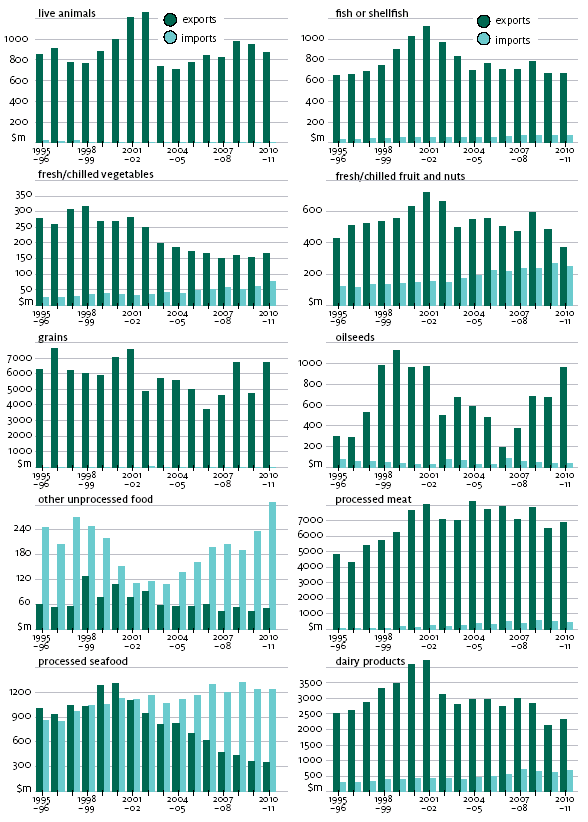

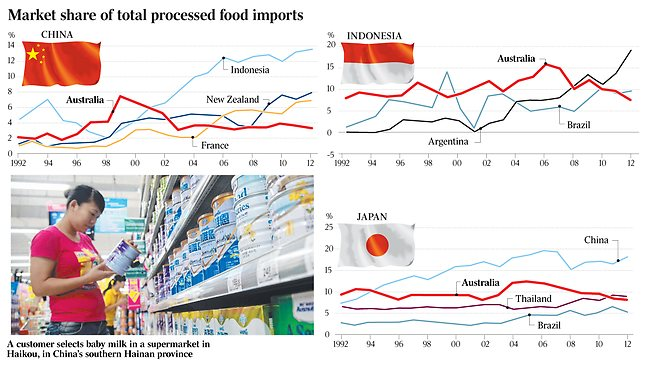

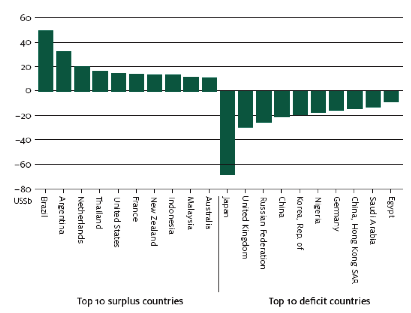

- As the graphs below show we have a lot to do in the export arena just to catch up with where we were, once upon a time, and not just with China. We have also lost market share with Japan and Indonesia. Farmers need to know the reasons why. Those who process the food they produce for export are losing market share, market share in one of the fastest growing markets on earth. Why is that. Are we too expensive?

- Given that progressive loss in other markets, what chance China?

And another reason is –

Some are years ahead of us.

Tesco completes China joint venture deal

Tesco’s 131 shops in China will be combined with CRE’s near 3,000 stores

Published: 29 May 2014

Tesco today made a bid for profitability in China by signing a joint venture to create the country’s largest food retailer, as the grocery behemoth tackles a tidal wave of problems at home and overseas.

The supermarket group has completed a deal to create a new business with state-run China Resources Enterprise in the country, after first proposing the tie-up last August.

Tesco’s 131 shops in China will be combined with CRE’s almost 3,000 stores and be called Vanguard.

Tesco has struggled to make money in China since launching in 2004, as it battled competition and struggled to build up scale.

Chief executive Philip Clarke, who is fighting fires across its business including in lacklustre economies in Europe, described the deal — which will see Tesco hold a 20% stake in Vanguard — as an “historic agreement”.

Shore Capital analyst Clive Black welcomed the move: “Tesco has the chance of having a profitable business: 20% of something is better than 100% of nothing.”

Tesco is expected to report next week its worst UK quarterly trading for more than 15 years, with broker JPMorgan Cazenove forecasting that sales at stores open longer than a year ago will have slipped 4%.

Clarke has pledged to invest £200 million into price, in response to the growing threat from discounters Aldi and Lidl, as well as traditional foes Morrisons and Asda

Ends.

Meanwhile back in Australia.

We discussed in Part 1 the second ‘Global Food Forum’, which was a gathering, a congregation for the day at a prestigious Sydney Hotel of a handpicked even famous and well respected group of people.

Anthony Pratt hosted the event. Mr Pratt is Chairman and CEO of Pratt Industries and Global Chairman of Visy Industries, the worlds largest privately owned paper and packaging company with an asset value of about A$7.64 billion.

From what I can gather most if not all the attendees were from the big end of town either loosely or deeply involved in finance, investment, agriculture and /or agribusiness and agricultural research.

The event was poorly advertised to ‘country people’. So not many attended and I think the cost for the day was about $500.

Both sides of politics were represented. The minister for agriculture and his shadow were there. Figures were not published but I got the feeling when reading the transcript and from the lack of independent (not News Corp) media reporting on the event, that not many ‘grass roots’ farmers attended.

As I wrote in Part 1 of this series the discussions of the day were transcribed and can be found at http://www.theaustralian.com.au/business/in-depth/global-food-forum

I hope some found time to at least read some or preferably all of what went on at the meeting, and in so doing got a feel for the mood of the day. It was the second such event. There is another planned on horticulture due within weeks.

The World is Different Now.

There was a time when the relationship between the ‘county’ and the ‘city’ in Australia was close. ‘Everyone’ in the city had a country ‘cousin’, or knew someone who was farming. Now the world has changed. Western Australia is no different to the rest of the country, in the last forty years the population has just about doubled and the number of farmers halved.

Of equal or perhaps more importance is that in spite of the communication revolution of the last decade or so with mobile phones, IPads, Tablets and the seemingly 101 or 1001 variants and applications (apps), the lines of communication between the ‘farmer’ the food producer and the ‘consumer’ have deteriorated until they are non-existent. Stand in the supermarket some time and watch how many rushed-off-their-feet shoppers search the packet of food they are buying for the country of origin.

The consumers when surveyed say they do care about the country of origin of the food they eat, they are patriotic, they would/do want to buy Australian, but in reality the decision is not theirs, they can only buy what is offered to them. In too many cases, even with glasses on it is difficult to read many food labels – frustration then takes over.

It’s a Fight Between Two in Australia.

It’s hard to believe that the regulations, the law, allows for there to be just two major food retailers, Woolworths and Coles to monopolise (+80%) of the retail food trade in Australia. Consumer protection is not, officially, a concern

There is an argument that so long as Coles and Woolworths fight to be the cheapest, or at least to tell the people they are the cheapest the happier the government will be. ‘Cheap food = full bellies = happy punters/voters. The average Australian consumes twice as many calories a day as they need.

Coles is owned by Wesfarmers. There is a touch of irony that Wesfarmers was formed out of the Great Depression by the farmers of Western Australia and became one of the biggest agricultural cooperatives in Australia if not the world and in many ways was the template for the AWB. Now it screws the ancestors of those same farmers on milk price and when driving prices down, down, down, someone has to get less, less,less, because Coles’ profit is world standard.

Coles and Woolworths between them account for +80% of retail food sales in Australia and as retailers rank 17 and 18 in the world. That world ranking is interesting, we will come back to it later.

The population of Australia is 23.5 million, and all of the retailers ranked above them (See Table 2 below) operate either in America or the EU, where the population is ~400m in the EU and ~317 million in America.

Coles and Woolworths fight each other for market share with a ferocity that has to be seen to be believed. They spend millions of dollars on building, protecting and maintaining their images.

Both believe they are the best food retailers. Woolworths promote themselves as ‘The fresh food people.’ Coles on the other hand heavily promote that their main purpose in life is to drive prices to the consumer, Down, down, down.

That slogan is an extension of the 1970s song of the same name by the rock band ‘Status Quo’ and they, ‘Status Quo’, (older now) perform the jingle in Coles’ advertising campaign.

Both Woolworths and Coles suggest in their media messages that they are a happy ‘cheap food’ connection, between a happy producer and the happy consumer – but they are not, if anything Coles and Woolworths are the reason why producers are increasingly unhappy and view Coles and Woolworths with animosity and suspicion as they fight each other for market share and use their suppliers as the weapons of war.

Table 2.

Let the Battle Begin.

‘Deliberate and with malice of forethought’ is usually an expression used in a court of law, but in this case it can be perfectly applied to fresh milk pricing.

It’s an old story now, but it’s a story worth retelling, in fact it’s a story that must be retold in all it’s bloody detail, because it has given us a perfect case study of what NOT to do if we have any ambitions as an agricultural industry, to produce food for export and especially to this land of the ‘Golden Fleece’, this land of unlimited potential we are constantly being told about – China.

Coles, owned by Wesfarmers, made the unilateral decision that it was going to retail fresh milk at $1 a litre and made no secret that milk would be used as a ‘loss leader’. That is a product to encourage people into the store.

Woolworths quickly followed. Overnight milk in the supermarkets around Australia, became cheaper than bottled water and carbonated flavoured water. The milk processors on being told of the decision – that they in turn would be paid less, had no alternative but to pass on an inevitable milk price cut to the producer, the dairy farmer. So the retailers once again took control of the food production chain.

Coles and Woolworths must have known that the price the producer would receive would be below the cost of production. Their behaviour was nothing less than selfish brutality with malice of forethought. If either claims they didn’t know the cost of production, then they have admitted to unbelievable incompetence.

http://tractorvideos.net/milk-vs-red-bull-english-version/ (Only for those who don’t mind a little bad language)

The milk processors and the dairy farmers didn’t believe they had the power to say no to Coles and Woolworths. The beer barons did.

The major liquor outlets in this country are owned by the same companies who own the Coles and Woolworths. They enjoy nearly as big a market share of the retail liquor industry as they do of the food industry. So the same companies own +80% of the supermarket trade and about the same of the liquor trade, including the pubs.

The liquor retailers decided they were going to do a similar thing with beer as they had done with the dollar a litre campaign with milk. The brewers heard of it and stopped their delivery trucks. No deliveries.

Power is something which the rural industry lacks. It has a thousand clamouring voices when it needs just one strong one. A voice which can stand up to Woolworths and Coles on behalf of its constituency and say no.

We will never know what would have happened if every dairy farmer in the country, or at least the majority, had said NO, and tipped the milk down the drain. I say majority because I don’t know if there are essential services that must have fresh milk.

Had the dairy industry said no to Coles and Woolworths, there would have been a run on powdered milk. There may have been riots at coffee shops from the latte deprived, the cappuccino morose and there would probably have been little children crying because their breakfast cereal didn’t taste the same. I reckon three days and Woolworths and Coles would have given in.

The same thing happened in the UK and the story is the perpetrators of the scheme, that is the men who devised the scheme in England for Tesco (think) were imported into Australia so they could teach us a thing or two about modern marketing. The film clip below sounds so familiar.

http://www.bbc.com/news/uk-england-essex-18969664

Photo:Reuters

Do Coles and Woolworths care about farmers?

Coles and Woolworths caused hurt, anguish, financial hardship and mental illness in the dairy industry in Australia, and it continues to this day. All for nothing as far as they are concerned.

As far as I am concerned Coles and Woolworths will never be forgiven for what was in effect an act of selfish bastardry. Four years ago they decimated returns to dairy farmers simply because they didn’t care what price producers paid to fund a ‘loss leader’ so they, the retailers, could get more people into their store.

This reprehensible example of what became copy-cat marketing, caused unnecessary direct and collateral damage to the Australian dairy industry from farm gate to milk processor.

Slowly it emerged there were substantial casualties. The objective of selling milk for $1 litre had been for one side to gain market share and they failed when the other side found out did the same. One wonders here about management competence, there was obviously someone in the perpetrators, Coles management team, stupid enough to believe that the other side wouldn’t respond?

The net effect on market share for either side, was nil. The net effect on milk consumption, up or down? – nil. The net effect in the trenches on the financial and mental health of the people in milk production chain right back to the people who did the 4am milking of the cows – immeasurably bad.

Milk production has declined by over 1 billion litres in Australia in the last decade.

Using ‘loss leaders’ is not a new trick, it’s as old as retail itself. What is different is that one time the retailer paid for its own marketing, if it wanted to sell below its buying price then that was its own business.

Now the world has changed in Australia, the retailers are powerful enough to make the producer pay for the loss leader. Somehow the retailers have developed a position where they have the producers believing they are doing the producer a favour by stocking their produce, even a staple like milk.

Taken to its logical conclusion the major retailers will decide which producers will survive in Australia and which won’t. The consumer will not have a say because all they can buy is what is on the shelf.

Milk is not the only perishable product that is subjected to the major retailers deciding, irrespective of market forces, what the price of an item will be way in advance of it’s advertised sale date. It goes on all the time.

The price of food specials, especially fruit and veg are advertised daily in both the state and local press. Those advertisements have to be placed well in advance of publishing day.

So the retailer will know at least a week or more in advance what they are going to pay the producer for whatever is in the advertisement. That is market power. That is control. Read the advertisement.

It’s no good the retailers saying the buy mainly from contracted producers. Every capital city in Australia has a fruit and vegetable market and the major retailers are active in those markets, often setting the price for the market, because, after all, they are the market. Next time you are in your capital city get up at 5am and wander down to the fruit and veg markets, you’ll see what I mean.

In spite of all the advertising and the jingles and the sanctimonious hand-wringing, pleading of the multi millionaire Chief Executive Officers of our major food retailers in this country the big question is are they telling the truth, have we got cheap food?

The answer is a resounding NO! Have a look at Table 3. Those countries who pay more for their food than we do are in a far less fortunate position than we are and unlike us, they have little or no chance of being able to be self sufficient in food.

Coles and Woolworths and the companies who acquire food for them, scour the world for the cheapest food they can find. The Australian Government is not interested in the price of food, we had better get used to that. Governments of all persuasions, Left or Right are only interested keeping the people happy with ‘cheap food’ and the cheap food claim is a con, but say it often enough and people will believe it to be true.

Table 3

|

Country

|

Consumer Price Index

|

Rent Index

|

Consumer Price Plus Rent Index

|

Groceries Index

|

Restaurant Price Index

|

Local Purchasing Power Index

|

|---|---|---|---|---|---|---|

| Norway | 145.16 | 61.54 | 104.97 | 137.08 | 166.66 | 89.81 |

| Switzerland | 142.49 | 64.86 | 105.18 | 147.75 | 139.88 | 137.03 |

| Venezuela | 119.05 | 38.12 | 80.16 | 141.17 | 92.80 | 12.16 |

| Angola | 117.92 | 137.36 | 127.26 | 107.07 | 112.64 | 42.33 |

| Denmark | 115.09 | 42.10 | 80.01 | 101.85 | 133.40 | 91.59 |

| Australia | 114.59 | 61.52 | 89.08 | 111.96 | 101.16 | 100.49 |

| Iceland | 113.58 | 43.14 | 79.73 | 118.92 | 106.86 | 64.83 |

| Luxembourg | 107.41 | 69.79 | 89.33 | 91.93 | 120.47 | 107.17 |

| New Zealand | 106.70 | 43.52 | 76.34 | 107.59 | 92.72 | 84.16 |

| Ireland | 105.62 | 40.23 | 74.19 | 101.16 | 101.30 | 89.55 |

| United Kingdom | 103.14 | 45.30 | 75.34 | 97.12 | 101.87 | 90.04 |

| Finland | 101.95 | 34.58 | 69.57 | 97.82 | 101.61 | 96.56 |

| France | 101.95 | 37.62 | 71.03 | 101.30 | 99.69 | 86.87 |

| Belgium | 101.13 | 36.10 | 69.88 | 96.05 | 105.55 | 82.38 |

| Singapore | 100.98 | 95.86 | 98.51 | 90.42 | 60.72 | 65.17 |

| Kuwait | 99.82 | 43.07 | 72.55 | 133.92 | 59.04 | 71.92 |

| Netherlands | 98.70 | 41.78 | 71.35 | 78.92 | 112.44 | 91.81 |

| Sweden | 98.53 | 33.16 | 67.12 | 95.60 | 97.37 | 101.91 |

| Bahamas | 97.70 | 47.35 | 73.50 | 92.84 | 86.65 | 91.42 |

| Japan | 96.69 | 38.44 | 68.70 | 101.71 | 58.20 | 90.86 |

| Italy | 95.76 | 31.49 | 64.88 | 84.75 | 102.47 | 72.47 |

| Israel | 91.55 | 36.28 | 64.99 | 81.22 | 94.35 | 76.71 |

| South Korea | 91.41 | 38.62 | 66.04 | 110.90 | 52.87 | 78.08 |

| Canada | 89.61 | 36.99 | 64.32 | 97.25 | 78.56 | 101.88 |

| Austria | 87.66 | 33.89 | 61.82 | 85.74 | 77.13 | 89.05 |

| Germany | 86.82 | 31.60 | 60.28 | 77.41 | 75.96 | 105.80 |

| Cyprus | 85.06 | 19.77 | 53.68 | 79.40 | 83.13 | 65.03 |

| Greece | 80.79 | 14.44 | 48.90 | 68.80 | 79.19 | 44.56 |

| Malta | 80.18 | 20.88 | 51.68 | 67.91 | 83.61 | 72.10 |

| United States | 76.97 | 37.82 | 58.16 | 83.66 | 66.12 | 125.63 |

| Hong Kong | 75.86 | 86.04 | 80.75 | 80.56 | 54.82 | 68.02 |

Information courtesy Numbeo : http://www.numbeo.com/common/terms_of_use.jsp

The other big con is the assumption that our supermarkets are buying ‘cheap’ food overseas. We have established that what they buy is not cheap according to the world-wide cost of a basket of groceries. The same brands can be found on the shelves of supermarkets across the world.

We can assume we pay world parity prices because of our position (number 6) on Table 3. We probably have higher transport costs than most.

We would expect, if we are realistic, that those countries with less favorable climates than ours, like Norway and Iceland, would have to import more food than a country like Australia where there is little we cannot grow ourselves, so it did come as a surprise that Australia is the sixth most expensive country in the world for groceries.

All the retailers in Table 2 who are above Coles and Woolworths, run their businesses in far bigger markets than Australia. In the EU there are ~400 million people and in America ~370 million. In Australia there are just 27 million. So the population of Australia is about 7% of that of the EU.

Tesco the dominant retailer in the UK had a market share last year of 29% with a revenue US$100574m from a total population of 64 million people or their market share of about 21 million people. Coles and Woolworths have a combined revenue of US$106822m from a population of 80% of 27m people, or 21.6 million people. (Tesco market share tutor 2U)

The figures above indicate that Tesco from roughly the same number of customers have an annual revenue some 6 billion less that the combined efforts of Coles and Woolworths and they achieve that performance in spite of intense competition from major international retailers, whereas Coles and Woolworths have but one competitor.

Food processing in Australia decimated.

The Australian food processing industry has been decimated. According to the Australian Food and Groceries Council in 2011-12, 335 food processing businesses closed down in Australia and moved overseas claiming the unit cost of production was lower in other countries. So Coles and Woolworths increasingly buy from foreign processors.

An ANZ review of China’s food sector shows and increase of 225% in food processing and manufacturing in the decade 2001 to 2011, from 18,000 to 41,000.

Wages are a major component in running any business. In Australia we pride ourselves in leading the world in agricultural technology, from planters and seeders right through to harvest. There are some tasks, like fruit picking, which cannot be mechanized.

As Australian rural depopulation has continued unabated, Australian growers continue to compete for local labour and each year rely more on imported labour. So where does Australia stand, compared to our international competitors when it comes to hourly rates of pay? Why do people want to come here to work both legally and illegally?

All hourly rates in US$. It will come as no surprise that Australia has the highest hourly rate in the world, in 2013 it was $16.88. Next was France at $12.09; New Zealand $11.18; UK9.83; United States $7.25. Going down the scale it gets unbelievably low. Poland $2.83; China $0.80; India $0.28.

The other great index used is what is called the ‘Big Mac Index’ ®. How many minutes of work does it take for a worker on the minimum wage to buy a ‘Big Mac’? Australia 18 minutes; US 35 minutes; China 183 and India 347 minutes or 5.7 hours.

Statistics on minimum wages and ‘Big Mac Index courtesy, Business Insider Australia, August 20 2013. The price of the McVeggie is unknown and is from the first vegetarian McDonalds Restaurant to open in India. Photo ibtimes.uk;

Currently the fresh fruit, vegetables and meat we eat are predominantly home grown. We import, often at quite high prices and by air-freight, items that are out of season in Australia. Oranges, grapes and onions from California. Miniature sweet corn from Thailand. Kiwi Fruit from Mexico and Asparagus from Chile to name just a few.

The high prices paid by the consumer for many of these imported items shows quite clearly that the Australian consumer ‘will’ pay for what they want. In the retail trade, in fact when selling anything, to maximize profitability the seller determines, usually without the buyer knowing, what the ‘bearable price’ of an item is.

This happens from Mc Donalds to motor cars. Push the price up until sales slow or stop, then reduce the price until sales start again. Psychologists are still unable to explain why we respond favorably to $2.99 rather than $3.00, when we pay $3.00 anyway.

There is ample evidence that Australian producers of fresh food are going further into debt each year and that increase in debt seems to be concurrent with the increasing domination of the fresh food market by Woolworths and Coles. The major retailers, like they did with milk, determine the price of the perishables they buy from Australian producers. Constantly we read in the press about a ‘take it or leave it’ attitude.

That means that Coles and Woolworths in their bitter war for market share are driving down the prices they pay producers, while, paradoxically, a basket of groceries from them is the eighth most expensive out of the 119 countries surveyed, and as far as revenue (takings) is concerned they come in at 18 and 19 behind the giants of America and the EU. Coles profit for 2013 was $1.53 billion. Merrill Lynch analyst David Errington observed that Woolworths’ margins of 9.3 per cent were the highest of any retailer in the world. (Oz Blog)

Woolworth don’t do too badly compared to others around the world:

Table 4.

Home Brands.

Increasingly what both Woolworths and Coles call ‘home brands’, that is goods of all types from baked beans to toilet cleaners are appearing on the shelves. Home Brands feature, have the best position on the shelves, and often one has to go looking for one’s favourite brand like Heinz. The only reason ‘Home Brands’ are given prominence on the shelves is because there is a bigger margin for the retailer, than there is from a ‘branded’ product. There is an argument, which I would support, that we have been ‘dumbed down’ on quality with ‘home brand’ goods.

Where do home brands come from? All over the world far as I can see they don’t, it would appear, support local processing and the figures support that contention. So what are we doing to ourselves or what are we allowing others to do to us, all in the name of market share. We are losing our processing industry, exporting jobs and importing more food, food that we could grow and process ourselves.

Do not be misled by the figures on imports and exports of processed food out of and into Australia. The following was written by an R Dosser, and is in the Parliament of Australia Library. The future of the Australian processed food sector … www.aph.gov.au › … › Parliamentary Library Briefing Book

Exports to imports

Australian Bureau of Statistics (ABS) figures suggest that in the period from 2003–04 to 2009–10, the domestic market for food (including fresh food) grew by approximately 46.0%, while the processed food sector grew by only 32.2%. The sector does not appear to be keeping up with demand.

Meanwhile, imports of processed foods grew by approximately 62.0% during the period.

While Australia is a significant net exporter of processed food, the beef, sugar, wine and dairy industries account for over 72.0% of all processed food exports. These industries accounted for around 38.0% of Industry Value Added (IVA) for the sector in 2010–11.

Source: DAFF Food Statistics, various years.

So when we are told we are doing all right in the export area for processed food exports, but after a bit of digging around and we find over 72/% of the total in processed food is in the big ticket items. When looked at over time it can be seen that we are going backwards in our endeavours to export processed food. Backwards. Here’s the proof, again not my figures.

Table 5.

Net processed food exports.

In Part 1, I was mostly complimentary to those who gave their opinions as whether Australia could become the ‘Food Bowl of Asia’, in itself a bit of political sloganeering prior to the last election which seemed to light the fire in the bellies of those who still think Australia occupies the same place in the world as a food producer as it did when there were less than half the present world’s population. Or when they were young and ‘women were thankful’. And men of course – lets not go off down there!

That we have lost that position and we are reminded of it every day when another food processor leaves the country. This from the same Parliamentary briefing document:

The increase in imports of processed foods, typified by the importation of Italian canned tomatoes—the value of which has increased from $33 million in 2007 to $51 million in 2012—has shown that processed food industries face international competition.

The domestic market for processed food is dominated by Coles and Woolworths. For most processors, growth hinges on Coles and/or Woolworths purchasing and retailing their products. Coles and Woolworths are fiercely competitive. They and their customers have demonstrated great price sensitivity, often to the detriment of more expensive domestically grown and made products. Exposure to competitive pressures has revealed the extent to which some parts of the food processing sector are unable to compete with imports.

This means, does it not, that Coles and Woolworths control the processed food industry in Australia? That means, does it not, they also influence what we can export? In doubt? Look at tomatoes. Look where Heinz went.

Whether it is a good thing or a bad thing, whether strategically – from a food security perspective we are comfortable that two food retailers should control so much of Australian agriculture is for Australia to decide. At the moment I think I am the only one who cares.

In my view Woolworths and Coles are in the process of changing the face of Australian agriculture. Apart from our home grown fresh fruit, vegetables and meat, Woolworth and Coles now decide what country will produce the food we eat. Hard to believe?

Just examine the graphs below, virtually everything in light green is imported by Coles and Woolworths or their agents. Look at the direction which both imports and exports are going and draw your own conclusions!

Coles and Woolworths set the prices and the others, the other 20% or whatever it is, either follow or compound the sin by trying to beat the two majors on price.

Our performance is cause for worry.

Table 6.

Australian Food Statistics 2011-13

Australian Food Statistics 2011-13

A quick look. Where the trend line for the dark green is down we are losing exports.

Where the light green line is going up we are increasing imports.

Can Australia become ‘world competitive again? Or is it a case of when its gone its gone and it will never come back? If we can get it back perhaps someone can tell us how? If we cannot then we have to get used to being reliant on imported processed food, which will only remain ‘cheap’ for as long as the country of origin can continue to process food cheaper than we can.

Perhaps in this context, if we want to look very broadly at those countries in the world who are self sufficient in food and those who are not, we get some perspective on the potential as a producer of food for the world:

Table 7.

Globally competitive – Agricultural Subsidies.

Of course agricultural subsidies come into this argument. If the marketplace will only give you $10 and the government knows the only way you can keep farming and ‘increase’ production and export to earn foreign currency, is for you to receive $15, history tells us other governments believe there is a future in food production at a cost that is acceptable to the consumer and they are prepared to subsidise that production.

Several articles in the ‘Global Farmer’, have detailed the extent of subsidies paid in other countries. The graph above just lends weight to the argument. Typically arable land in the EU attracts a subsidy of about A$363 per hectare every year. Is it any wonder that EU countries can attract Coles and Woolworths to buy processed potatoes?

If structural change is going to happen in Australian agriculture, and make no mistake it must, as represented by the majority of the speakers at the ‘Global Food Forum’, those same speakers need to appreciate they have to start talking, with understanding and patience, with the other half of any deal they may have in mind, the men and women now on the land – the ‘Country’ people.

What is decided now sets up agriculture in Australia for 2050.

‘The City’ will have to learn to communicate with ‘The Country’ in a manner, which will instil trust, encourage cooperation and develop discussion with the aim of working in concert towards common objectives, whatever they may be.

For at present there is far too much farmer suspicion of city folk and their rich friends, particularly if they come from the Middle Kingdom.

At the ’Global Food Forum’ according to the proceedings there was a bit of the usual pissing in pockets, but not a lot. My favourite was a comment from the unnamed MC of the first session, ‘There’s just one thing I’ll say, though, about Coles – and, you know, really, not without some controversy, obviously, for some growers – but Coles has done a standout job in driving prices down for consumers.’ He then proceeded to introduce the CEO of Coles. I could hear dairy farmers growling in the ether.

The MC had shown in one sentence he knew nothing of international food prices. Coles may have driven prices down, but down from where and to where?We have already seen on Table 1 that out of 119 countries listed Australia is the sixth most expensive for groceries.

That we have ‘cheap food’ only goes to prove the old adage that if you say something often enough people will believe you. On television the other night the CEO of Wesfarmers, the owner of Coles, repeated the claim that Australia has cheap food and he was smiling.

Australia is already losing market share for food into Asia, mainly to Brazil but really ‘to everyone’. A big message was that Australia isn’t the only one who can see the opportunity to sell more food into China and China knows it. China has stated that it will only buy quality food. As far as meat products are concerned it will thoroughly examine every facet of the journey from birth to slaughter.

So who knows what is going on in China?

The remark was made in a group discussion at the ‘Global Food Forum’ that London was closer to Beijing than Sydney and I thought ‘that can’t be true.’ So I looked it up and it is by about 500 miles and so is California closer, so that means Mexico is only another 500 miles more than that.

Then I find that TESCO, Britain’s biggest food retailer has had retail food stores in China for years, some 130 of them, and it has just lulled off a deal in food retailing where it will become part of a new company which will be China’s biggest food retailer. Does that give Britain a foot in the door or what? How interesting if Australia sells beef and lamb to the Brits in China.

Big take home message for me there was that we sell China a lot of iron ore but the rest of the world with food to sell may be just as close or closer to China as we are.

There is a classical twist to the $1 a litre milk story – or one could ask whether the Right Hand in milk processing really knows what the Left Hand is doing?

Running the risk of being boring but put the matter in perspective here, there can be no doubt the major food retailers in Australia, Woolworth and Coles, by declaring war on each other and using milk as artillery by selling it for $1.00 a litre, caused massive structural damage to the Australian dairy industry by forcing processors to reduce prices on to dairy farmers. Prices which, for some, were below the cost of production, so some producers went out of production or went broke, or both.

While all of this was going on in Australia there were stories of change in New Zealand. Stories of farmers going out of sheep farming, because of low lamb prices and going into dairy because of greatly improved prices for milk, presumably for milk products, milk powders, butter, cheeses, formula and so on. Big shift for farmers out of sheep and building new dairies.

Then we get stories in the press of the Chinese middle class paying A$10 a litre for fresh milk. China has endured a number of milk, and milk product contamination scandals. Remember China has or has a one-child policy, there is talk of this being doubled to two children. With 20% of the world’s population the real and increasing demand for milk in China will be immense.

Calves at China Modern Dairy’s 20,000-head farm in Feidong, Anhui province, were bred from highly productive foreign cows. Alex Frangos/The Wall Street Journal

China is investing heavily in building its own dairy herd, so nothing in life is certain, but it is unlikely they will ever become self sufficient in dairy products. The Wall Street Journal on April 23, 2012 put it like this:

Since 2009, China has become the world’s most important buyer of dairy cows, driving up prices for calves world-wide and putting pressure on other markets such as alfalfa and bull semen. China has imported nearly 250,000 live heifers, or cows that haven’t yet reproduced, since 2009, according to data tracker Global Trade Information Services. Last year it spent more than $250 million on 100,000 foreign heifers, about 25 ships worth.

Some farmers in countries that are exporting their prized heifers worry that in coming years China could go from customer to rival in the global milk market.

“It’s building the herds of our competitors,” says Nick Renyard, owner of a 550-head dairy in Victoria State, Australia. “It’s like selling the family silver, you can only do it once.

http://online.wsj.com/news/articles/SB10001424052702303863404577281302732745814

Courtesy of the ABC, full story at http://www.abc.net.au/btn/story/s3566675.htm

The top photo is courtesy ‘Dairy Connect’ The price per litre is A9.42 for Australian milk on the shelf in China. The other is Coles with the same milk at A$1.00 litre in Australia.

The milk may well have come from the same cows. The cost of production would have been about the same. The only major difference is milk was A8.42 a litre more expensive in China than it was in Australia and the Australia dairy farmer got the same price for both.

There was some concern among the delegates:

Those sharing the matter of amusement were: Longwarry Food Park’s Rakesh Aggarwal, between GE Capital’s senior managing director of the North America Food & Beverage Group, Chris Nay, and Rafferty’s Garden CEO Michael Tinkler. To be fair they did acknowledge that ‘farmers’ margins have been crunched by the aggressive price cuts of the major supermarkets.’ Photo: Shannon Reddaway. Full story at: http://www.brw.com.au/p/business/longwarry_wars_still_meaning_losses_mUD25QfK06r3hyhcGisgKN

As a result of the Australian major retailers demanding a reduction in the milk prices to consumers, the now infamous $1 per litre, major restructuring has taken place throughout the industry.

If there is one thing parts of Australia can do, it is produce milk. The $1.00 litre fiasco put a lot of dairy farmers out of business. Herds that had been built up over generations were dispersed, some to the butchers. Generations of breeding and so genetics were lost forever, they are irreplaceable.

Western Australia is now in the ludicrous position where it is no longer self sufficient in milk. It has to import fresh milk, thousands of kilometers from South Australia and the Eastern States, and the $1 litre policy remains.

According to the Federal Minister for Agriculture from northern NSW alone 16,000 litres of milk a week was being flown to China, where it was fetching $7 to $12 a litre.

According to Mr Joyce, China wants up to a million litres a week. Australia producers about 9 billion litres a week and there are, at last, moves in some places to lift production by renegotiating contracts with producers.

According to the Sydney Morning Herald, “They want to go up to a million litres a week,” Mr Joyce said. “This is sending signals to the market that if you want to pay people $1 a litre then you’re not going to be in business for much longer because there is a vastly greater demand, an insurmountable demand, that’s going to come into that place.”

The amount of fresh milk being flown to China is a fraction of Australia’s annual milk production, which is about 9 billion litres a year. The big dairy processors are working with farmers to lift that number through measures including fixed milk price contracts and having greater exposure to high margin products such as nutritional powders.

Still, Mr Joyce said the “smart thing” for the big supermarket chains to do would be to lift their prices and ensure more money was flowing to farmers.

“Otherwise you are … going to see more and more the conversion of milk to a dry commodity, the export of a dry commodity, to the exclusion of domestic supplies.

“What was a great trick for a few years there will turn into a very bad business plan in the long-term.”

This is a direct quote from the transcript of the ‘Global Food Forum’ made by Ms Judith Swales (above) MD of Fonterra, one of the biggest milk processors in the world. Talking of the potential in China she said :

‘I think in terms of, you know, what we see as a potential, I mean, there were figures bandied around but, you know, broadly, we would say that global demand will increase by 100 billion litres by – in the next 10 years. So that’s 10 times what Australia produces in milk the demand will increase by.’

So the reason we put the Australian dairy industry to the sword was because our two main retailers demanded milk at $1 a litre as a loss leader. There is ample evidence that they knew their demands would severely strain and even put some Australian dairy farmers out of business, yet they persisted. The consumer got their fresh milk at $1.00 litre, cheaper than water and flavoured carbonated water and wine.

Yet at one and the same time the managing director of one of Australia’s major milk processors forecast that over the next ten years demand in China will increase by (at least) ten times what Australia produces today. And to add insult to injury, at the same time as these wise people were talking about satisfying their selfish needs in Australia, we were dismantling the herd capable of capitalizing and progressively growing over the next ten years to meet the forecast need for fresh milk in China.

Is this an example of the limit of our strategic thinking in Australian agribusiness? Is this an example of how we are going to plan to meet the opportunities of the future? Is this an example of the thinking of the two most powerful food retailers in the country selfish enough to put their position in the marketplace and their dividends to their shareholders before growth in a industry on which they either depend, or have the courage to come out and say ‘If you don’t produce to our price we will go overseas’.

Is this how we are going to become the ‘Food Bowl of Asia’. Just another example of politic speak – hollow before and hollow again, simply because no one had done their sums.

I would like an argument to the contrary, but as far as I can see we are going to go nowhere, slowly. Maybe Asia will feed us as we price ourselves out of everything except non or minimally processed food which is really fruit and veg and fresh meat and grain. The rest and it’s a lot of the weekly shop is processed food and the way we are going the majority of that could well be imported.

For the first time in our history we shall be dependent on others for food. That’s not possible is it?

Roger- this is a great read and should be force fed to every single politician in this country. I care about what you have written and it is a good thing that I’m out here in the middle of nowhere as I feel like getting a star picket and going and hunting down a ceo that is shafting me and all my peers!

A comprehensive, substantial, and important read. It also a somewhat terrifying one, as an end customer who sees what the duopoly is doing, but struggles to find solutions to such large scale issues. Thank you for the dedication to sharing such meaningful information. In addition to the devastation caused to the agriculture industry; the impact on people paying inflated prices; and the insulting messaging/marketing; is the ever shrinking packaging/sizes available for all consumables/products that have double/triple/quadruple per gramme/ml prices. Because they “care about families”. It is as if the two headed beast is slapping everyone in the face, and then demanding we say thank you on our knees. It costs time, effort, and money, but I family and friends try to invest by researching to find and support independant and local businesses that have integrity and care about the impact they make, and the products they sell. If Australia wasn’t so big we’d drive to buy more products directly from farmers and producers. I watch in envy when they show the produce markets in England. If there is more that we as consumers/end customers can do to help support Australian agriculture … I am all ears. Thank you

Maybe time to revisit this topic, Pamela? It is constantly at the forefront of my mind, currently looking, again, at the increase in food imports. This week we bought a wonderful 1 litre glass jar of perfect peaches for $3.50 from IGA, they came to us all the way from Bulgaria. Now if that isn’t coals to Newcastle, I don’t know what is. Roger