The National Farmers’ Federation of Australia, the National Party and the Liberal Party, together with the Australian Labor Party, all believe that Australian agriculture can raise its production to $100 billion at the farm gate by 2030.

The National Farmers’ Federation of Australia, the National Party and the Liberal Party, together with the Australian Labor Party, all believe that Australian agriculture can raise its production to $100 billion at the farm gate by 2030.

That is an increase of 66.6% on the production of 2018 or an annual increase of about 4%, and presumably, though they haven’t said as much, they all expect the producers to make a profit every year— which is more than they do now — but they don’t tell you that.

There are some truly grim truths about the financial ill-health of Australian agriculture and they are all produced by government statisticians and the Reserve Bank of Australia.

Why these grim truths were ignored by the NFF when they set their $100 billion target, and why that target was endorsed by those who determine the the agricultural policy of this country, is for them to answer.

It would appear that there isn’t a minister for agriculture in Australia today, at both the federal and state level, who had any qualifications or hands on experience in agriculture or (agricultural) economics prior to being appointed to their agricultural portfolio. Even worse they all seem to have many other portfolios and being only human, the time they can spend on agriculture has got to be limited.

This must mean that our ministers of agriculture rely on advice from the federal and state government agricultural bureaucracies, the state and natio nal farmer organisations and those stalwarts of Australian agriculture, the MLA and the GRDC, who are kept fat by the millions of dollars of compulsory deductions levied on producers.

nal farmer organisations and those stalwarts of Australian agriculture, the MLA and the GRDC, who are kept fat by the millions of dollars of compulsory deductions levied on producers.

Ben Rees; B. Econ.; M.Litt. (econ.)

Ben is a seriously underutilized elder statesman in Australian agriculture, probably because he deals in facts, not emotional subjective dreaming in which many in the so-called high echelons of agriculture in this country indulge.

Ben recently presented a paper to the Royal Society in Queensland. For the complete article Rural Debt and Viability click on the link above and then at the bottom of the page when it comes up click on: Ben Rees on rural debt and viability. I will try and post the complete article on this website as soon as I can.

You may not agree with Ben’s opinion — but it will make you think and make you wonder what the so-called leaders of agriculture do in their working time — time, which we all pay for.

Just a glance at Graph 11, lifted from one of Ben’s papers, demonstrates that the problems facing Australian agriculture today have not been caused by drought and will not be fixed by building new dams — the rot started years ago — it’s called debt.

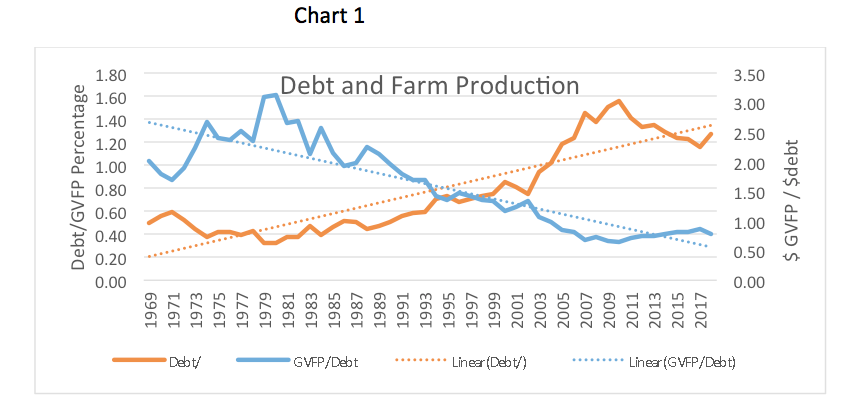

This is what Ben writes about Rural debt, gross value of farm production and net value of farm production: Graph 11 illustrates the impotence of the RBA to deliver required real sector policy. By 1983, GVFP was rising at the expense of NVFP. Beyond 1983, any relationship between debt and GVFP NVFP evaporates. Upward inflections in the debt curve are identifiable in 1988 and 1993 following tariff reform. Any relationship between GVFP and debt cease to exist beyond 1993; and; finally in 2003-04 the debt curve rises steeply cutting through the GVFP curve. Finally the GFC effect slows down the rural appetite for debt. From 2017, the debt curve gradient begins rising more steeply than the GVFP curve indicating that rural production is again being funded by rising indebtedness. Some good old fashioned fiscal policy was badly missing. (Ben Rees)

Nobody involved in agriculture providing they can understand basic economics like 2 + 2 = 4 – 4 = 0 can fail to see the the agricultural tragedy contained in Graph 11.

Australian agriculture has been on a productivity binge for the last fifty years. Since 1990, the gross value of farm production has grown from about $20 billion to where it is today at about $60 billion, a growth of some $40 billion or 200% in thirty years. Whereas the net value of farm production has grown from about $5 billion to about $20 billion an increase of some 300% during the same period, which looks great until we examine the debt, (red line) which has grown from $10 billion to just under $70 billion during the same period, an increase of an astounding 600%.

This increase in farm production has occurred as the number of farms has decreased. In 1970 we can see from Graph 11 that rural debt was just a few billion dollars and there were about 180,000 farms, the numbers are too small to calculate. By 2016 farm numbers have reduced to 100,000 (the NFF claims there are just 85,000 farms) and the debt has risen to ~$77 billion and by 2019 that debt has risen to $80 billion.

If we divide 100,000 by $80 billion it gives us an average farm debt of $800,000, and that is for all farms producing over $25,000. It doesn’t end there. In a publication produced by the federal Department of Agriculture and Water Resources for the Royal Commission into Misconduct in the Banking and Financial Services Industry in 2018, it is claimed that 70% of the aggregate broad acre debt was held by just 12% of farms.

On average these were large farm who produced some 50% of the total value of broad acre farm production in 2016-17. It should be noted that debt figure does not include the total credit facility limit which was estimated in the same paper at a whopping $86 billion. For many with large cropping enterprises an annual overdraft facility can, in the short term, double their debt exposure. No wonder so many feel as though they are standing on the edge of an abyss when the weather does not perform as planned.

The increasing debt levels have followed the increase in land values as shown in Figure 1. The ability to borrow against an asset, as we all know, has nothing to do with the ability to repay a debt. If the Royal Commission into Misconduct in the Banking and Financial Industry revealed anything it was that the banks were more than willing to lend against rising equity levels without determining whether the debt could ‘reasonably’ repaid by the borrower. It also showed that they showed no mercy to those who, for whatever reason, defaulted. Rural debt continues to rise at over a billion dollars a year.

However, the alarming result of the spiraling debt, highlighted by Ben Rees, is that $1 of debt is now needed to produce 64 cents of production as shown in Chart 1. Whereas in 2003/4 one dollar of debt produced $1 of production and in 1989 one dollar of debt produced $2.14 of production. What kind of crazy economics is that?

The billion dollar question must be, ‘How many dollars of debt will be needed to generate one dollar of production on the road to achieving $100 billion at the farm gate?’ Maybe the NFF have the answer?

Have another look at Graph 11 at the widening gap between net value of production and gross value of production. That graph begs the question whether there will be an acceptable margin between costs and returns to repay what now seems to be an inevitable mushrooming of debt.

Figure 1 Thatcherism

Thatcherism

Not many in the Australian Labor Party today will recognise that those two great reformers, Hawke and Keating, were devout disciples of Margaret Thatcher, and as a result of their adoption of ‘Thatcherism’ and its mantra of ‘the market economy’ Australian agriculture suffered as market support was gradually reduced to where it is today — virtually non existent.

What Hawke and Keating and all successive Australian Governments have failed to recognise is that the adoption of the market economy philosophy around much of the free world in the eighties and nineties did not affect the huge ‘market support’ or subsidies paid to agriculture.

Without US$580 billion in annual subsidies farmers in the EU , the United States of America and almost every country around the world could not survive.

Australian producers receive world prices for their exports and have some of the highest costs and the lowest yields in the world, particularly in wheat production — their competitors also receive world prices for what they produce, but they also receive government subsidies.

Where price is king in the food markets of the world it isn’t rocket science to conclude that Australian producers face severe competition in both our domestic and overseas markets.

Have a look around the supermarket shelves in Australia and see what is imported, and what, once-upon-a-time, was grown and processed in Australia.

Australian supermarkets scour the world for the cheapest food they can buy and every time they bring more food into Australia, they put another nail in the coffin of Australian agriculture.

One of the reason that rural debt is increasing is because of land purchase. Farmers have been buying more land in an effort to benefit from an economy of scale. Fewer workers because the sheep have gone has meant bigger machinery, bigger machinery means bigger borrowing. Again, it ain’t rocket science. The quwstion is, has it worked?

The Cost of Debt Funded Production.

Let us now look through Ben Rees’ prism at farm debt over time and what producers have been able to produce with that debt, Ben writes:

Chart 1 below empirically analyses debt to output as a policy efficiency performance indicator. The orange curve is Debt/ Gross Value Farm Production (GVFP) whilst the blue curve is calculated by dividing GVFP/ Debt.

2.1 Performance Indicator Outcomes

- Steeply positive gradient long term orange trend curve ( Debt/GVFP)

- Orange curve suggest that production has been debt dependent

- Steeply negative gradient blue long term trend curve ( GVFP/Debt)

- From 1984, declining efficiency as debt relentlessly consumes production

- In 1989, $1 debt produced $ 2.14 in output.

- By 2003-04, $1 of debt produced $1 of output

- In 2010, $1 of debt produced 64 cents in production

- From 1993 to 2013, sectoral performance lies below the negative sloping blue trend curve.

By any reasonable assessment, Rural Adjustment has not delivered theoretically expected outcomes from economies of scale, increased efficiency and rising productivity. Post 2003-04, both curves identify debt funded output as inefficient and unstable. Any other sector would have demanded a change in policy direction; but, agricultural leaders appear to have strongly believed the rhetoric of market theology that reduced farmer numbers structuring economies of scale would ensure long term sectoral viability. That simplistic arithmetic approach by industry leaders, major political parties; and, commentators has been a gross violation of established economic knowledge.

Ben is right. We must conclude that there is no plan for agriculture in Australia apart from that being offered by the NFF and endorsed by all political parties. What does that say for their understanding of established economic knowledge?

Is debt going to strangle Australian agriculture?

In  October 2018 the National Farmers’ Federation (NFF) presented Australian agriculture with an enormous challenge —a vision for the future:

October 2018 the National Farmers’ Federation (NFF) presented Australian agriculture with an enormous challenge —a vision for the future:

17th October 2018

The National Farmers’ Federation (NFF) has laid down a bold vision for the industry: to exceed $100 billion in farm gate output by 2030.

Based on our current trajectory, we know industry is forecast to reach $84 billion by 2030. This suggests that we still have significant work to do over the next 12 years if we are to achieve our vision.

To support their plan, the NFF have developed a road map which tells us how Australian primary producers from wheat, sheep and beef producers to bee-keepers and everyone in between what the ‘road’ is to the national farm gate producing $100 billion by 2030.

The NFF road map is complicated. I wonder how many farmers, agricultural producers and their advisers and critically, their bankers, those who lend them money, have read it — and more importantly, been able to understand both the map and their position on it?

There is no doubt that agriculture in Australia requires re-structuring. Whether the NFF Road Map is the way forward I leave for you to decide.

Is $100 billion by 2030 now the clarion cry of Australian agriculture?

To produce $100 billion of farm gate output by 2030 will require a 66.6% increase measured in dollars of production across the face of Australian agriculture in a little over ten years. Seriously? Given our recent history of growth is that figure realistic? 66.6% growth would require an annual 4% nominal growth rate in the Gross Value of Farm Production (GVFP).

There are three ways of achieving the NFF vision:

- Assume that the gross value of farm production (GVFP) will increase by 66.6% and assume that yields will not and producers will make a profit or:

- Assume that yields by will increase by 66.6% and prices will do what they seem to have by-and-large done over the last ten years and remain constant or decline and producers will make a profit.

- A mixture of both of the above and assume that rural debt will continue to increase and producers will still make a profit.

A 66.6% increase in the dollars generated at farm gate in what is now just 10 years is a massive ask. Maybe the NFF are banking on new rural industries to help reach the target and well they may, but realistically, surely, the heavy lifting will have to be done, as usual, by the producers of wheat and beef and to a lesser extent canola, wool and sheep meat.

If there is one common thread that runs through all of the research I have put into this article so far, it is that Australian agriculture faces global challenges from ernest competitors who can produce and ship product into markets where we are active at a price which Australian producers would find and more importantly are already finding, difficult to match.

Our reputation for quality is appreciated by those who can afford it, but as markets expand, like the exponential growth of the middle class in Indonesia and China, so too does the market for products of a lesser quality than that which is available from Australia. Prime examples are buffalo meat into Indonesia at the expense of Australian beef and Australia’s massive loss of market share to Argentina and the Baltic States in the wheat market of the same country. The last one is hard to explain when we can almost see Indonesia from two of our major export ports in Western Australia.

What do the Banks think?

The Commonwealth Bank are not as optimistic regarding growth as the NFF, their view, as a major lender, is that production will fall across all agriculture mainly due to a drop in rainfall. A 50% drop in grain production and a 40% drop in livestock by 2060 is predicted. If Australian agriculture is to reach the NFF target of $100 billion by 2030 it will need the support of the CBA.

In contrast to the Commonwealth Bank there is a publication called Australian National Outlook – 2019. The joint Chairmen of Outlook 2019 are Dr Ken Henry AM when he was Chairman of the NAB and David Thodey AO, Chairman CSIRO. The publication is a joint effort by over 50 contributors from some 24 organisations who forecast a better picture than the Commonwealth Bank, but with many challenges for agriculture and for the nation, it is worth a read.

Beware, it is complicated, ambitious and apart from some wild assumptions on climate change, (my personal bias) a very well thought out document, and in many ways it is a pity it is not a fundamental part of the national conversation on the future of agriculture.

It makes one wonder whether those in the NFF who claim to lead this fine industry really understand, seek or accept the considered opinion of others who are already major participants in the industry of agriculture in this country. What is of note is that the Australian National Outlook forecasts a far more modest growth to $80 billion in agricultural production but by 2060, rather than the NFF target of $100 billion by 2030.

The NFF say they consulted widely before settling on the $100 billion target: The NFF led a 6-month consultation effort to inform the Roadmap. It began with a Discussion Paper which distilled insights from leading experts, before commencing a nationwide roadshow, where we spoke to over 380 farmers and other industry experts to field their views. As we consolidated this feedback, we engaged regularly with industry stakeholders and experts to ensure the ideas we’re putting forward are credible and impactful.

The NFF say they have consulted with 380 farmers. They claim there are 85,681 farmers in Australia. So they consulted 0.4435055% of farmers in Australia in the preparation of their Road Map! Hardly statistically significant.

It is also reasonable to ask whether the NFF consulted with the CSIRO, the NAB and any the fifty other industry brains who contributed to the Australian National Outlook 2019 who have a different view of the future to that of the NFF.

The has been a massive loss of knowledge and skills in agriculture.

What really shook me from Ben’s analysis of the agricultural economy, is the loss over the last thirty years of experience and skill in agriculture — this must surely present this industry with a huge challenge? Again, this is from Ben’s paper:

4.1 Performance Indicator Employment

ABARES commodity statistics for 2018[i] , shows agricultural employment peaking historically in 1990-91 at 387, 000; but, falling to 279 000 in 2017-18 (29%). Meanwhile for Australia, over the same period, employment rose from 7.8 million to 12.5million (60.3%). It stretches the mind to think the decline in agricultural employment alongside such strong national employment growth is explainable by consolidation of farm size and applied technology. Agricultural policy needs to accept responsibility for this employment outcome.

The reality is that structural industry reform began with the 1988 tariff reductions which were ratcheted up again in 1991. Orderly marketing of both major industries wool and wheat were discontinued over 1989-90. It cannot be explained as mere coincidence that agricultural employment began to decline from its peak in 1990-91 as a result of technological adoption by the farm sector at the same time structural reform of agriculture began in earnest.

Chart 3 identifies empirically that agricultural employment contracted strongly across broad-acre agriculture; and, the self – employed small scale farmer. Broad-acre employment decline appears from 2002 coinciding with the worsening of the Millennium Drought. The real loss of employment though lies in the self -employed and owner manager classification from 1992 onwards. The impact of the self- employed owner manager is particularly important as that group comprised largely the part time skilled labour force residing in rural Australia. Policy driven policy of Rural Adjustment “shipping out” small inefficient farmers would seem a more logical contributor than technology.

[i] ABARES commodity statistics, 2018, Table 1.2 , Australian employment by sector.

- Long term decline in broad acre employment 52% between 1992 -2018

- Self-employed fall 71.4% between 1992 to 2018 (192 000 to 55 000)

- Millennium Drought emerging1997-2009

- GFC 2009- 2013

- 2013+ Current Drought

The decline in agricultural employment whilst employment in the wider economy continued to rise strongly is a damming policy indicator. If agriculture was likened to a private firm, a clean out of the board, senior management, and advisors would be expected.

How true!

In the next issue of Global Farmer we will examine whether our main agricultural industries of beef, sheep and grain, are capable of playing their part on the road to achieving $100 billion by 2030. The question must be asked can they do it and more importantly, who has already claimed they can, because somebody has? Haven’t they?