China buys 30% of Australia’s exports.

China buys 30% of Australia’s exports.

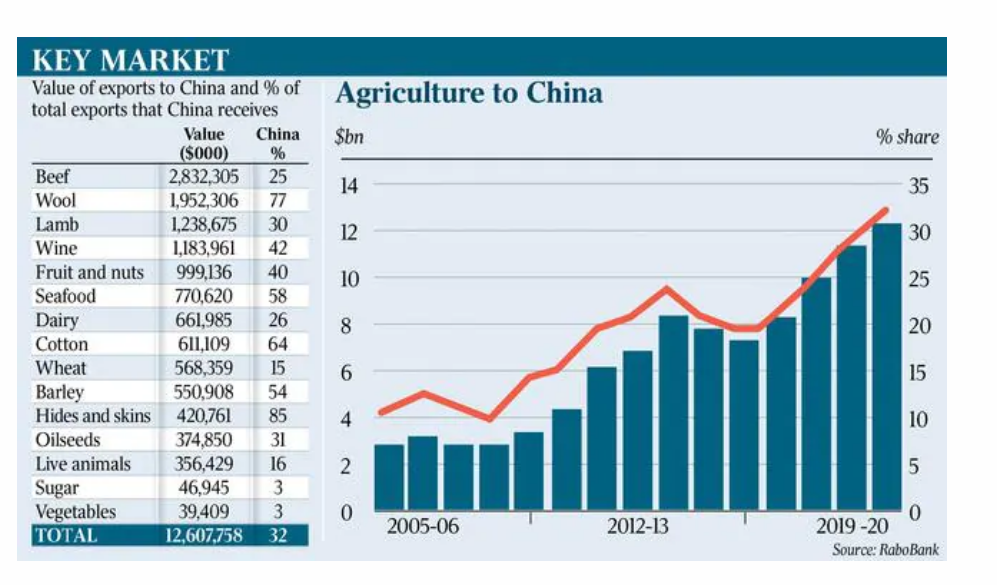

The news that China accounts for thirty percent of Australia agricultural exports demonstrates how reliant the Australian rural economy has become on the People’s Republic of China.

That news caused some to question the wisdom of the marketers of Australian food and wine in placing such a heavy reliance on just one customer.

That is valid question, but did you know that China buys 30% of everything Australia exports.

Agricultural exports are just a mirror image of what is going on in the rest of the country. In 2017-18 Australia exported goods and services worth a staggering $123 billion to China equal to 6.7% of the Australia Gross Domestic Product.

According to recent Department of Foreign Affairs and Trade figures, China, annually, takes $79.5 billion worth of Australian iron ore, $13.8 billion worth of coal and $16 billion in natural gas exports add to that figure the $12.6 billion of rural products and the total is $122 billion. There are 12,000 Australian businesses selling goods to China either directly or through Hong Kong and there are 3,000 Australian businesses based in China.

Where would we be – where will we be without China?

Our ties with China don’t stop there, in 2017 China spent $11.7 billion in Australia on education-related travel which includes student fees and living expences and another $4.1 billion on tourist travel. Both the tourism and the education industries are feeling the real pain of the loss of some of that income during this pandemic, especially tourism which has stopped.

China accounts for 50% of world steel production and a large proportion of that is made from Australian iron ore (2017) worth nearly $80 billion, our next biggest customers for iron ore were Japan and Korea taking $7 billion and $6 billion respectively. In the financial year to June 2020 iron ore exports to China reached $100 billion.

There are worrying signs that China may well be diversifying its sources of iron ore. Australia’s biggest competitor has always been Brazil. The advantage Australia has enjoyed is not only quality of ore but proximity, we are closer to China than Brazil.

The news recently that China has opened more home ports which are capable of taking the huge the new Brazilian ‘Chinamax’ ships which have a cargo capacity of 400,000 tonnes, reducing both freight costs and delivery time, has caused some consternation in Australia. Australian exporters use the ‘Capesize’ ships which range from 250,000 tonnes to 300,000 tonnes.

China has also been making big investments in smaller iron ore deposits in Africa and there is the potential for the ‘Chinamax’ ships to be used on that route and allow the blending of lower grade African ores with the high grades from Australia.

The view is that China needs Australian iron ore and its coking coal to make high grade steel, but the view is also held that as China develops other trade links with Brazil and other countries in South America for soy bean and beef in particular, so it may shift some of its iron ore business away from Australia.

There is no doubt that Australia would find it difficult to find other markets for its iron ore should China reduce its imports from this country.

As far as coal is concerned China does get a lot of its coal imports from Mongolia but that trade declined by over 50% after the outbreak of Copvid19, as a result Australian coal exports increased. There is constant talk now in China regarding their domestic coal mining and the need to make it viable and the need for imported coal both from Mongolia and Australia is constantly under revision. I think ‘may hay while the sun shines’ would be good advice for the coal industry that exports to China.

There are Alternatives here at Home.

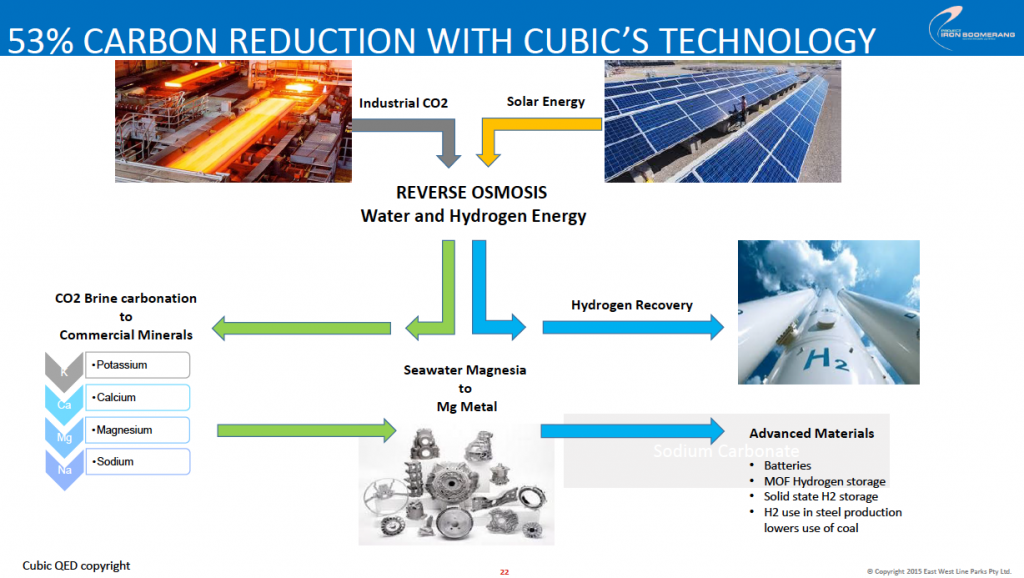

A couple of months ago I wrote about ‘Project Iron Boomerang’ one of the most exciting projects I have seen since moving water from the Kimberley or the Ord via ‘Ernie Bridge’s Dream or ‘Colin’s Canal’ to the south of Western Australia was rejected by all the lily-livered naysayers over the last forty years. Had we made the move then the world of agriculture would be a different place today.

A couple of months ago I wrote about ‘Project Iron Boomerang’ one of the most exciting projects I have seen since moving water from the Kimberley or the Ord via ‘Ernie Bridge’s Dream or ‘Colin’s Canal’ to the south of Western Australia was rejected by all the lily-livered naysayers over the last forty years. Had we made the move then the world of agriculture would be a different place today.

‘Project Iron Boomerang’ is all about making steel here in Australia. It involves moving iron ore from WA to Queensland and moving coal from Queensland to WA via a transcontinental rail link. It is also a high tech project involving world beating processes producing high grade steel at a super-competitive cost. The steel would then be exported from ports in the Pilbarra and Queensland to customers around the world.

‘Project Iron Boomerang’ is all about making steel here in Australia. It involves moving iron ore from WA to Queensland and moving coal from Queensland to WA via a transcontinental rail link. It is also a high tech project involving world beating processes producing high grade steel at a super-competitive cost. The steel would then be exported from ports in the Pilbarra and Queensland to customers around the world.

We have the best coal in the world and some of the highest grade iron ore why not make steel at home? It is a huge project but amazingly, it would only produce less than 5% of the world’s steel needs. Remember China producers some 50% at present and we import most of our steel from China.

Can Australian Agriculture Prosper without China?

The big question is can Australian agriculture survive without the markets in China and can China manage without what it imports from Australia?

The answers are probably no and yes respectively.

It is not so much that China accounts for 30% of ALL Australian agricultural exports, what is important and fundamentally scary is the heavy reliance of some products like wool, wine, seafood, cotton, barley and hides, where all except wine, rely on China for +50% or more, of their business, a reliance that goes directly against all the rules of marketing and business 101 and plain old common sense.

The old adage of ‘He who pays the piper calls the tune’, is applicable here, when one customer controls over 50% of the output of a business, there is little room to negotiate both on price and supply.

Between the Devil and the Deep Blue Sea – China – Coles and Woolworths.

China takes 30% of our rural exports, that is bad enough, just poor business, but the other side of the coin virtually all fresh produce which is consumed in this country is grown in this country, and the major supermarkets control 60%+ of that trade, so who is the patsy?

There is to be yet ‘another’ enquiry the ACCC, the competition watchdog will launch a three-month investigation into the power imbalance between farmers, food processors and supermarkets. I can tell them from somewhat bitter experience that the two big supermarkets who control 60% of the food trade do set the prices both with processors and in the fruit and veg markets and with deals direct with the grower.

How did Australian agriculture allow itself to get into this position? The big supermarkets control the home food market and China controls many of our main export markets. The producers are price takers yet again. If Australian agriculture is to grow, even grow up, there has to be change.

The United States enacted a law in 1890 called the Sherman Anti Trust Act, which prevents individuals or groups forming a monopoly and controlling market prices.

If Australia values its home grown produce and wants to become self-sufficient once again in food, and reduce our annual purchases of food worth $20 billion from overseas, then legislation of this kind is needed in Australia.

Whether we have the politicians with the intestinal fortitude to do that is doubtful in the extreme, the rural voice in the parliaments of Australia is poor to non-existent, the rural voice outside of the parliaments is non-existent. The NFF is useless and non-representative of the farmers of Australia and the State Farmer Organisations seem to live in a little world of their own with few if any members and reliant on sponsorship from industry for an income.

China and 30% of Agricultural Exports.

China and 30% of Agricultural Exports.

Lets face up to it, China has been seen as an easy market for the sellers of Australian agricultural products. W e can hardly call them marketers can we? This conflict that we always have in that a ‘tactic’ is easier to execute than a long term ‘strategy’. The Chinese are strategists we are and always have been tacticians.

e can hardly call them marketers can we? This conflict that we always have in that a ‘tactic’ is easier to execute than a long term ‘strategy’. The Chinese are strategists we are and always have been tacticians.

China opened its doors and its markets to Australian farmers and it still enjoys being Australia’s biggest customer for agricultural products but now it is showing that it knows how to wield the power it has as Australian agriculture’s biggest customer.

Is China punishing Australia over barley imports? Another problem has emerged as I write, CBH this time is being accused of seed contamination in a barley shipment.

Beef exports are going down and the wine industry faces an uncertain future and the wool market where China buys over 70% of the clip, has crashed

Is China trying to make our agriculture and maybe even our national economy subservient to them — do they want us to acquiesce to their aggressive Wolf Warrior diplomacy?

Is this the voice of China? Are we in over our head? Can we reduce our reliance on China and maintain our agriculture?

‘There are few signs that Australia intends to stop provoking China, or to attempt to ease escalating tensions. Instead, its insistence on continuing along the US’ lose-lose path toward decoupling will undoubtedly cause huge damage to its already severely injured economy.’ Global Times 31.8.20.

How High is the Water Momma? – This Deep!

Beef – Is there a future in China?

Beef – Is there a future in China?

The majority of what we export to China, with the exception maybe of wine, are commodities with little if any value added to them. There is not a great deal we can do with beef and lamb apart from cut it up and put it into boxes.

In June of this year one of the importers of Australian beef Eric Huang of the Xiamen Xiangyu Group, who import 20,000 tonnes of beef a month from Brazil, America, Canada, Argentina and Australia commented that unless the restrictions are lifted on the three Australian abattoirs that are currently banned, he may well have to look to America for extra product.

Between 1000 tonnes and 2000 tonnes of Australian beef per month is still being bought by China, giving a total of nearly $3 billion for the year, but costs are increasing due to the proliferation of Australian abattoirs now supplying the market.

So will China go to America if it reduces its beef imports from Australia? The reports from earlier this month indicate that Brazil may be its preferred supplier and this would tie up with other trade that it is doing with that country.

‘Brazilian beef exports including fresh and processed products reached a monthly record of 194,093 tons during July, up 17% from the same month a year ago, according to the Brazilian Slaughterhouse Association (Abrafrigo).

China currently accounts for 57.5% of Brazilian exports in the sector. In July, the Chinese market reached the highest level of the year in purchases from Brazil, at 115,180 tons. So far, the biggest acquisitions had been seen in May, when the Chinese imported 83,900 tons of beef.’

The cumulative total until July 2020, shows total Chinese imports (including Hong Kong) reached 634,624 tons – almost double the 381,325 imported in the same period in 2019.(Merco Press.)

According to the MLA, Australia exported just over 300,000 tonnes of beef to China in 2019, which was worth some $2.6 billion.

Brazil is not the only country which is ramping up its beef exports to China, Argentina, who suspended sales early this year due to the pandemic, enjoyed a good year with beef exports to China reaching some 634,000 tonnes in 2019, up some 50% on the year before.

So the only conclusion we can come to is that Australia’s beef exports to China are tenuous to say the least. There are other suppliers, Uruguay for instance sent 70% of its exports to China last year making up some 20% of China’s needs about the same as Brazil and Argentina. So between them South American countries could well account for 60% of the Chinese beef market. There are 50 million cattle in Brazil twice as many as in Australia, 14.3 million in Argentina and about half that number in Uruguay.

Can we sell Australian beef anywhere else? It will be difficult to find a home for the beef worth $3 billion that currently goes to China. The EU is probably out, they take a little from Brazil and Argentina as does the UK, the UK and EU quotas are pitifully small at present. There is already some pressure from UK producers regarding the prospect of Australian beef and lamb getting a hold in their market.

Is there anywhere else? Japan? Maybe but America has a big hold there, ditto Korea. The rest of Asia? Maybe, but it will test the marketers when they set about meeting the needs of many different markets.

Stop Press September 2 2020.

Meat import flows to China from Brazil is up 140%, from the USA its up 544% and Spain is up 204%. Australia is only up 24%. It does appear we are being shunned.

Courtesy: Thomas Elder Markets September 2020.

Wool.

With 77% of the wool being produced from a flock that is half the size it was in 1990, all now being bought by China and with Australian producers now complaining about the prices they are receiving, the question has to be, ‘what else did you expect?’ China has you by the short and curlies.

British and New Zealand non-merino wool producers are reported to be destroying their wool clips because the price is so bad or non-existent. What is happening now has been coming for years.

Nothing has changed in the wool industry in Australia in the last 150 years apart from the introduction of the mechanical shearing hand piece which was introduced in 1888.

If we haven’t got the drive and the brains and the money to process our wool in this country then the wool industry will disappear in the next 20 years and be replaced by meat sheep.

Forget the Texel Ram Lamb that sold for $600,000 in Scotland, have a look at the catalogue for the whole sale, good meat producing sheep are in demand in the UK and in Australia.

Sheep numbers in Australia are now at a 116 year low and forecast to decline by a further 3.5% this year and it has dropped 12% in the last 3 years in spite of the demand for sheep meat especially lamb. The Australian national flock now stands at about 63 million.

There are areas in Australia where cereal growing, especially wheat is becoming marginal and the risk, the cost to plant, grow and harvest are extreme and among the highest in the world with yields among the lowest in the world. Maybe a long term strategy is to look at meat producing sheep and goats?

The current estimates from the MLA are that the sheep flock in China will increase to 175 million in 2020 and sheepmeat production including lambs will reach 2.64 million tonnes an increase of 175,000 tonnes on the previous year. That looks to me like China is trying to produce as much lamb, mutton and wool as they can.

The Chinese have also bred a merino which they call the Mountain Merino. Wonder what that means for the Australian fine wool trade? They bought some of our best genetics some years ago.

In the late 80s I remember questioning the advisability of allowing the Chinese to buy Australian merino genetics and I was told, I was assured no less by an Australian wool grower, who incidentally was making the sale, that selling Australian merino genetics to China would expand the global wool market. They were halcyon days for the Australian wool industry then the crash came thanks to Hawke and Kerin abandoning the wool industry. When the stockpile was sold the Australian wool industry was ruined.

The markets for wool clothing are still there and probably growing for carpets and furnishings as world affluence improves. It seems that South Africa and South America both process their wool ‘at home’, so the Chinese processors have to rely on their own production which is increasing and on Australia and New Zealand for imports. As sheep numbers decline in Australia and New Zealand so the Chinese inherit a larger share of the apparel market which for the last 100 years Australian agriculture has spent billions on developing.

Lamb and Mutton.

Australian and New Zealand lamb and mutton must be of a high quality because in 2019 China imported 390,000 tonnes an increase of about 70,000 tonnes on the year before. This amount pales into insignificance against the Chinese domestic production of some 4.9 million tonnes.

Considering that we sell to lamb to China that is worth $1.2 billion or 30% of what we produce, what do you make of this?:

The average export price of lamb to the US is 2.3 times higher than China. Lamb remains a niche product in the US but is growing in familiarity, particularly among millennial consumers through food service channels.

In 2018-19 lamb sales to China increased by 40% and mutton sales increased by 80% on the five year average. It would seem that in spite of the efforts China is making to increase its domestic production of sheep meat there will continue to be probably an ever growing market in China for the Australian sheep meat producer.

New Zealand producers are more dependent than their Australian cousins on China for sheep meat sales, in 2019 some 54% of all NZ lamb and mutton exports went to China. Their other two major markets are America and the UK.

Live export of sheep has declined over the years, in 2019 just over 1 million sheep were exported live, the majority being lambs and hoggets and all went to the Middle East.

The markets for sheep meat in the future appears to be strong but dominated by the demand from China. The Australia – China trade relationships are somewhat tenuous at present and if anything deteriorating.

Building the lamb markets in America would seem to be a sound strategy, maybe in Canada as well? The UK is nervous about Australian lamb imports, home production together with what they take from New Zealand is sufficient for their market.

Mutton it seems can always be sold in the Middle East and probably in Europe in greater quantities.

Wine.

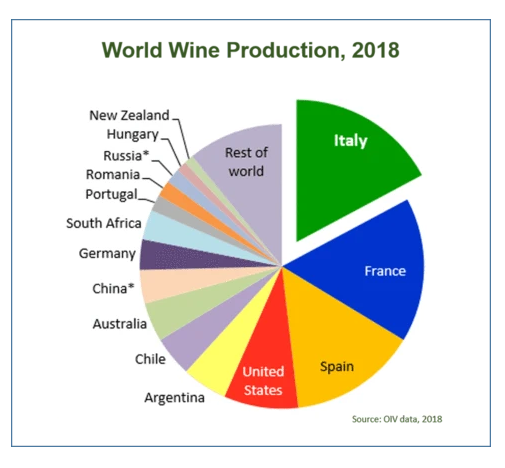

Australian wine represents 37% of all the wine imported into China. The industry is now being investigated regarding contravening anti-dumping legislation. Where it will go is anyone’s guess.

Australia is the biggest supplier of wine to China, second is France and then Italy and Spain. China accounts for 42% of all Australia’s wine production.

There can be no doubt that the reliance of Australian wine producers on China makes them vulnerable to pressure, even coercion. The market in China has been pursued by Australian wine producers at the expence of the market in the UK market which at one time was its biggest customer.

I remember back in the late 80s a friend went to Chile to look at some ‘Fusilade’®trials, at the time we were testing around the globe in an attempt to hurry up research results. One of the comments he made on his return was that Chile was in the process of planting a vineyard the same size as the then entire Australian vineyard. On the pie chart above it looks like he was right on the button.

Seafood.

Can the seafood industry survive without China, which takes nearly 60% of all it produces? The rest probably goes to Japan and maybe Taiwan, I haven’t looked it up because I have forgotten what crayfish tastes like and the price of local wild fish is very high.

We import 70% of the fish consumed in this country and we are surround by oceans. Can anyone explain?

Cotton.

Bit like wool, over 60% goes to China and no doubt a lot comes back in finished garments. If we have to export it wouldn’t it be better to have an agreement with a Developing Country like India or even Pakistan if they can get themselves sorted?

China controls our cotton industry no wonder they have invested heavily in cotton country.

The Change in China is Remarkable.

Why China we must ask? What has driven us to China or China to us?

Over the last twenty years or so China, like India has reduced the number of undernourished in their population by half from 16.2% to just over 8% in the case of China and from 22% to 14% in India.

In 2003 the total food imports in China (all in US dollars) amounted to $14 billion of which America had the largest share at $3.7 billion followed by Argentina at $2.1 Brazil at $1.6 and Australia at a miserly $366 million.

By 2017 the picture had changed substantially. In that year China imported food worth $105 billion. The largest share went to Brazil at $22.7 billion (mainly soy) followed by America at 18.1 billion, Canada at $5.6 and Australia at $5.4 billion. That is an increase of 650% in just 14 years.

The numbers from The Australian and those I have quoted on the growth of China food imports from the Centre for Strategic and International Studies do not match. Something to do with exchange rates or with what they consider to be food probably, what is of interest is the growth in the reliance of China on imported food.

In 2017 China paid US$248 billion in subsidies to it’s farmers.

In Pigs and Poultry China is the Biggest.

To feed its pigs and poultry even during the ASF epidemic China purchased soy to the value of $38 billion down from just over $40 billion in 2014. It wasn’t so much how much China purchased but from whom they purchased. Australia is not the only food supplier being punished by China.

‘As US-China trade tensions escalated in 2018, Chinese imports of US soybeans nearly halved from $13.9 billion in 2017 to just $7.1 billion in 2018. China turned to Brazil in response, expanding soybean imports from the South American agricultural giant by 37.9 percent to $28.8 billion in 2018. Nevertheless, China’s appetite for soybeans exceeds the production capacity of Brazil and most of the world combined, leaving the US to fill the gap.’

China imports somewhere in the region of 65% of the soy available on the world market, or 30% of the world’s production. China cannot grow sufficient protein to feed it’s enormous pig and poultry industries so it has to rely on imports. Pork and chicken are the main staple meat sources for its 1.4 billion people. Beef consumption, though increasing dramatically, is at the high end of the market.

Meat Consumption – China Feeds its People.

‘In 1975, China consumed a mere 7 million tonnes of meat.2 That figure had grown to 86.5 million tonnes by 2018, making it the largest meat consumer in the world. At 55.2 million tonnes consumed, pork was China’s top meat source in 2018 by a wide margin. On a per capita basis, China consumed 48.9 kilograms (kg) of meat per person in 2018 – roughly half as much as the US (99 kg per capita) and Australia (93 kg), but slightly higher than Japan (43 kg).’

‘In 1975, China consumed a mere 7 million tonnes of meat.2 That figure had grown to 86.5 million tonnes by 2018, making it the largest meat consumer in the world. At 55.2 million tonnes consumed, pork was China’s top meat source in 2018 by a wide margin. On a per capita basis, China consumed 48.9 kilograms (kg) of meat per person in 2018 – roughly half as much as the US (99 kg per capita) and Australia (93 kg), but slightly higher than Japan (43 kg).’

The Moral of the Story is?

The moral to this story is that China, is now dependent on other nations for vital food supplies ranging from raw materials like soy and corn for livestock rations, to lamb, beef and some pork. No doubt the trade posturing will continue but in the final equation the Chinese people will demand that there is meat on the table. There is little evidence that they will demand food from Australia, therefore:

The sixty four thousand dollar question, the twelve point six billion dollar question actually, is whether China can manage without produce from Australia and can Australian agriculture manage without China?

That question leaves me uneasy to say the least.

Very detailed analysis. Looks like we will have to keep changing product mix and market focus as we and everone else has always done.

It would be interesting to see whether we could re-establish a hi tec low labour cost wool processing industry here. Energy, water and labour costs are all rising rapidly in China and by some measures are as high or higher than they are here. Rising freight prices work in favour of high value added products vs raw material.

As for wheat, there is little long term future in wheat exports from Australia, there is 100 m hectare of abandoned farmland in the European part of the former Soviet Union, most of which is more fertile than anything in Australia as well as millions of hectares of undeveloped lands in the Asian parts. In 2019 Russia and the Ukraine combined exported almost 4 times as much wheat as Australia.

With the development of belt and road rail lines and export facilities along the Black Sea and improved rail access from those countries to Europe and better growing conditions in Canada it is hard to see us competing in future.

As for China. It can become avoid imports of food from the west if it needs to. China has about 5m square km of farmable land. The EU has a farm surplus on 1.4m square km. Applying European farming techniques would bring China to about 95% and Russia and the Stans could easily supply the rest.

Thanks for that when/if you go through what I have written, I forecast the demise of the wheat industry some time ago. Thanks. I have sent an email.