A global cartel has manufactured a gas crisis in Australia, when in fact there is a world wide glut. On the 14th of April Professor West predicted (and it happened) that the Prime Minister would be prevailed upon by the cartel to stay away from doing for Australia what the Carpenter Government did for Western Australia when it secured for WA 15% of the Pluto gas field production for WA. The cartel will plead with the Turnbull government not to interfere with ‘the market’ and encourage it to persuade State governments to issue licences to explore the Australian landscape for coal seam gas (CSG) so as to avoid an impending gas shortage. Put ‘there is no gas shortage’ into you search engine and you will find that the lies of the cartel prevail.

According to Prof West there is no such thing as a ‘gas market’. Six big companies have formed a cartel and control the market price: Santos, Exxon, BHP, Origin, Arrow Energy and Shell. Michael West claims ‘Markets have visible prices and quantities on the bid and offer. The cartel even hides information about its gas reserves from government.’

That last sentence in the paragraph above is quite alarming, Prof West dealt with it like this: As this gas belongs to Australians and energy security is a national issue, it is reasonable to demand more disclosure. That the gas companies are scrambling to fulfill export contracts is not something which can be blamed on consumers or on the states in respect of their CSG policies.

The price of gas has increased three fold, that’s right three fold in recent times. Given there is a national and international glut, it is reasonable to assume that market forces should have driven prices down. That is what cartels are all about, they control and manipulate markets. The price of gas is so cheap on the export market, that Japan can afford to and has, re-exported Australian LNG. It is bizarre that gas customers in Japan buy Australian gas more cheaply than Australians. Some of this gas is drilled in the Bass Strait, piped to Queensland, turned into liquid and shipped 6,700 kilometres to Japan … but the Japanese still pay less than Victorians.

The AAAC have had a look at the behaviour of the gas cartel. Have a look at that opinion. I’m no corporate lawyer I just wonder what these regulators are all about when in spite of the evidence, the cartel remains in business ripping off the Australian market. Are they too powerful for the AAAC? If they are then we have to ask the question who runs the country?

There is an abundance of the cleanest coal in the world and contrary to popular belief there is a glut of liquefied natural gas (LNG) in this country. Is it not then utterly reasonable to expect that the small and largely concentrated population of Australia should pay less for their electricity than consumers in those countries who have to import coal and gas? In an economy where all Australian manufacturing industries are screaming out for a comparative advantage to keep them internationally competitive, they are in being knee-capped by a largely foreign owned gas cartel who have forced up the price of electricity to where it is the fifth most expensive in the world. Is that un Australian or what? Not only is industry hurting at the high cost of electricity, time and time again there are heart-wrenching stories in the press reporting that the most disadvantaged in our society, the old, the poor, the weak and infirm, are suffering because the cannot afford the high electricity costs. No doubt there will again be a blanket appeal this winter, when in reality we have that much cheap gas, nobody should be cold this winter.

By now, Prof West reports, a Bruce Robertson, an analyst with the Institute for Energy Economics and Financial Analysis (IEEFA), will have presented to the Columbia Law School in New York, a paper describing how this gas glut will only get worse, and how excess supply and faltering demand are leading to a breakdown of the contract pricing.

When all of Australia’s LNG plants are working to capacity, Australia will replace Qatar as the world premier exporter. At present Qatar earns three times as much in royalties as Australia for selling the same amount of gas.This is just another example of Australia’s broken gas policy. Who are the incompetents who negotiated the gas royalties? All of this is reminiscent of the mineral boom in Western Australia where, if you discount a billion dollar stadium and a half billion dollar makeover of the Perth foreshore, it is hard to find, outside of Perth any evidence in state infrastructure of a decade or more of a mineral boom.

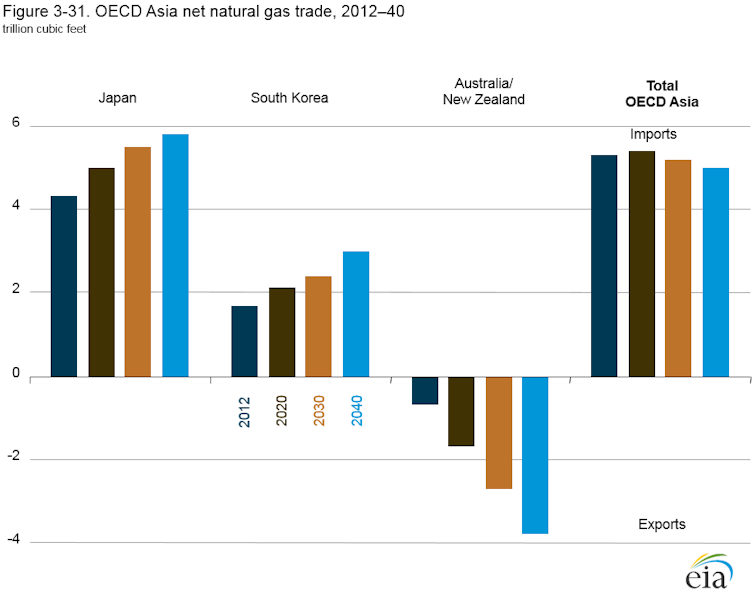

The news is not all that good. World wide demand for gas is decreasing with Japan’s needs expected to decline by 30% by 2020. In fact the future looks gloomy unless we find ways to attract Australian industry to make products that are world competitive. We know we are handcuffed to the most expensive labour in the world so we can do without the manacles of just about the most expensive electricity in the world.

I wonder how much the cost of electricity played in the decision of the world’s leading auto manufacturers to leave Australia? Based in South Australia, the land of windmills and the home of a Premier called Don Juan but also in Victoria where they still believe in energy miracles and where they were quite happily paying more for gas than the Japanese while they closed down coal fired power stations, which generated ‘cheap power’.

This a chilling prediction from the ABC website. We now know that Victoria should have been building gas fired power stations to replace Hazlewood and who knows they may have decided gas was too expensive? The cost of that decision is in this article, of which this is part: The head of the Food and Grocery Council says manufacturers will quit Australia if affordable, reliable energy cannot be guaranteed, as concern grows about the cost of power and the stability of the electricity grid with Victoria’s Hazelwood power station due to close in a fortnight.

It is not my intention to reproduce Professor West’s article here, I just urge you to read it, the link is in the first paragraph. Prof West and Bruce Robertson do present some very worrying statistics which should whet your appetite if you are worried at all about what the future may hold. Here they are direct from :

There is simply too much supply coming on line, says Bruce Robertson. While demand falls, global LNG capacity is tipped to rise by 30% between 2015 and 2020.

Contract defaults are already afoot. India’s Petronet has renegotiated its LNG contract with Qatar’s Rasgas, cutting the price in half over the 25-year term of the deal.

Meanwhile, the International Energy Agency (IEA), the energy adviser to the OECD, has pulled back its forecasts for gas demand for four years on the trot. IEA estimates growth in gas consumption will decelerate to 1.5% a year between 2015 and 2021.

Ironically, the very fact of a thermal coal market in structural decline and a global glut in gas conspire to push down fossil fuel prices and delay the transition to renewable energy. The gas cartel, though, by its actions in restricting domestic supply, is deliberately keeping prices high.

For its part, the government has been faithfully trotting out the cartel line that the states must bring new unconventional gas online, coal seam gas. This is not only expensive to produce but poses inestimable environmental risks to farmland thanks to the fracking process.

The cartel has manufactured a fake gas crisis. Australia is soaked in gas. The answer is a domestic reservation policy starting now.

I take the last sentence to mean that it is long past time the Australian Federal Government and all the State and Territory Governments put this gas cartel in its place and in so doing ensure that all Australians and Australian industry benefits from cheap power.

The media know that they have been manipulated and lied to. Past and present Governments of Australia and every State and Territory Government in the Commonwealth should be incandescent with rage at the way they have been duped. That is assuming all levels of government didn’t know what Michael West has revealed. If they did know and are part of the conspiracy of selling off Australia’s resource, Australia’s gas, for a royalty that we now know to be a pittance, then there are questions to be answered and heads to roll, because this government and governments before them have been incompetent in dealing with assets that belong to the people of Australia.

We are reminded every day of Australia’s debt. We are told every day that we are spending more than we are earning. As I write, prior to the budget, the name calling between the political parties has already begun.

I wonder what our self important politicians have to say to the evidence that:

- The evidence is undeniable that for decades no State or Federal Minister has been capable of protecting the natural gas resources of Australia.

- They haven’t known the price of natural gas on the international market so they have allowed the cartel to give it away. To the extent that others have on-sold it and made a profit.

- They have agreed to gas royalties that are so low they must have made Australia the laughing stock in the international oil and gas industry.

- They have allowed Australia’s natural resources to be plundered by an international cartel and they still refuse to challenge that cartel in public.

- There is evidence on the public record (in The Conversation article) that the cartel knew they were manipulating the domestic gas market and forcing the Australian people and Australian industry to pay well above international prices and for some as yet unexplained reason, neither the minister’s responsible or their many staff had an inkling of what was going on. Again the incompetence should be explained.

- An article appeared in the last few days in The Australian, which showed that Australian industry is hurting badly from the hike in gas prices, even the Federal Minister Frydenburg, doesn’t know or isn’t letting on he knows the truth. Two companies mentioned are involved in value adding to agricultural products, wool and tomatoes. The cheapest canned tomatoes in our supermarket are and have been for years from Italy. Maybe they buy gas from Japan? Minister, please explain.

- it is my view that cartel wishes to remain in Australia then they should start paying back the billions of dollars they owe the Australian people.

Just for interest:

The salaries of the CEOs of the cartel mentioned are as follows:

Santos: Kevin Gallagher.Pay package: $1.8m year basic salary. Potential to earn a further $1.8m in short-term incentives and $2.7m in long-term incentives. Allocated $1m in rights in recognition of previous incentives now extinguished, payable over two years.

Exxon: Gets a bit complicated but the man in charge when the deal was done has been called to the White House so this was the announcement: Exxon Mobil Corp. is planning to put about $175 million in cash into a trust for Rex Tillerson, who stepped down as the company’s chief executive officer on Jan. 1 in order to pursue a new career opportunity at the U.S. State Department. Prior to receiving his call-up papers Mr Tillerson had managed to get by on: Compensation. In 2012, Tillerson’s compensation package was $40.5 million. It was $28.1 million in 2013, $33.1 million in 2014, and $27.2 million in 2015. In late 2016, Tillerson held $54 million of Exxon stock, and had a right to deferred stock worth approximately $180 million over the next 10 years. There is nothing on record about Mr Tillerson’s replacement.

BHP: For 2016, Andrew Mackenzie’s pay was reduced to US$2.2 million (A$2.9 million) compared to his 2015 pay, which, in turn, was almost 50 percent of his 2014 compensation. It would place his current salary at about 100th ranked compared to other Australian CEO’s 2015 package.

Origin: A new CEO: Mr Calabria will receive a fixed salary of $1.7 million, including superannuation, with the opportunity to earn short and long-term bonuses incentives capped at 130 per cent of his fixed salary.

Arrow Energy: Hard to find but about US$400k plus Options of US$ 3m. Best I could find was here.

Shell Oil: In its annual report released on Thursday, Shell said CEO Ben van Buerden’s remuneration totalled €5.576m ($6.12m) in 2015, from over €24m in the previous year.