The Changing of the Guard.

Preamble.

Over recent times as Australian agriculture has endured droughts, poor prices and incompetent governments; amid the chaos there have been two major overriding topics for discussion.

The first has been trying to separate the rumours, the gossip and the chit chat from the truth regarding the extent, the size of Chinese investment in Australian agriculture, in land, as distinct from agribusiness or food processing.

There is a body of opinion that claims Chinese interests, including Sovereign Funds have made substantial purchases of land in Australia, using a variety of investment vehicles, which have enabled them to avoid scrutiny by the Foreign Investment Review Board (FIRB).

We have the figures from the FIRB and we name who the biggest investors in Australia agriculture have been over recent times and the results will surprise you. China is at the bottom of the list, below Hong Kong. So why the public and in some cases political interest in China who ‘officially’ appear to be a minor investor? Is it xenophobia, fear, nationalism? — they all mean the same thing really. Do we fear China and is that because we don’t understand them? Whose fault is that?

These are difficult questions for us as a people and as an industry. It is a far more serious question for the media, and I believe the media should shoulder a great deal of the blame, because they have wrung every bit of emotion they can out of China and Chinese investment in Australia, giving voice to rumour and innuendo. Yet the records show that the media have been at least less than diligent and probably lazy in failing to report who the big, billion dollar plus, non-Chinese investors have been in Australian agricultural land over recent years.

The second big question is, forgetting agriculture, can we now manage, as a country, without China? We have all but exported our manufacturing base, everything from engineering, to clothing to hardware to food processing — you name it, what we once made ourselves we now get from China.

If it’s ‘Made in China’ it’s designed to be affordable. The more we buy from China the more dependent we become on them and the more vulnerable we are as the alternatives become uncompetitive.

The resource boom of the last last decade should have made Australia strong but there’s a fly in the ointment, Barclay’s Bank Kieran Davies reports that Australian household debt is equal to 130% of Gross Domestic Product (GDP) this compares to an average of 78% average across the advanced world making us more vulnerable than most to another financial crisis.

So we’ve spent the boom on paying ourselves wages and salaries big enough to build the biggest houses in the world with ‘entertainment centres’ and a bathroom for every resident, double garages to hold the boat and the dual cab 4wd ‘trucks’. Enough left over to holidays to exotic destinations and the like — instead of spending our money on our country, on the infrastructure future generations will need to make us world competitive.

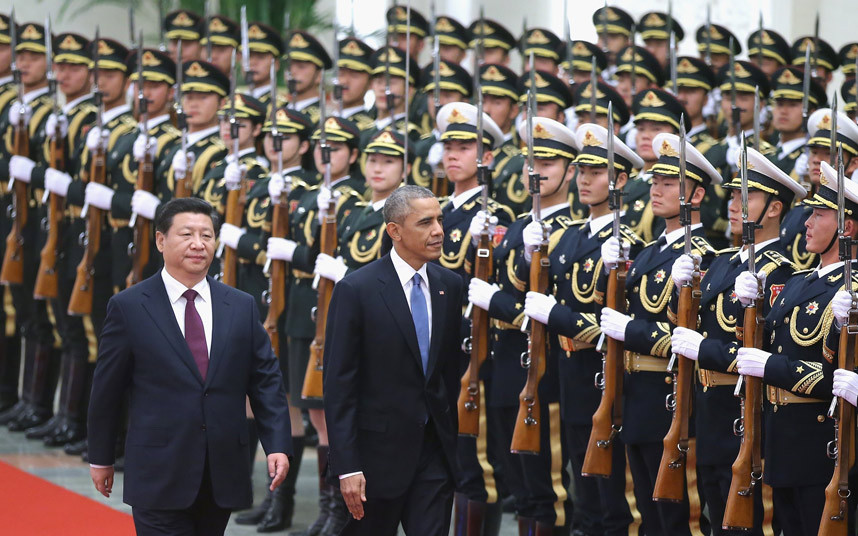

China is now the world’s largest economy. America will fight them for that position — but no matter what happens, China’s influence on the Australia will continue to grow.

Australia’s challenge will be to find the point of balance in our relationship between our greatest ally, America, and the country we cannot manage without — China.

The China Century

The 21st century may well be the Chinese century, the century they have been waiting for, for so long. It is surprising that the world has so far failed to recognise that 2014 could well have been the last year the United States could claim to be the world’s largest economic power.

Three months into 2015 little has been said or written, especially by China and the US, that China is now in top position, where it will remain for a very long time and return it to the position it has held through most of human history.

That is according to Prof Joseph E. Stiglitz, http://en.wikipedia.org/wiki/Joseph_Stiglitz said to be the fourth most influential economist in the world today. He writes it is very difficult to compare the gross domestic product of various economies. Technical committees come up with estimates of what are called ‘purchasing power parities’ which provide what are probably imprecise numbers but they do provide the basis for assessing the relative size of economies.

According to Stiglitz, ‘Early in 2014, the body that conducts these international assessments — The World Bank’s International Comparison Programme — came out with new numbers. (The complexity of the task is such that only three reports have been issued in 20 years.)’

The report was contentious and momentous because it showed that China would become the world’s biggest economy before anyone expected and would be there by the end of 2014. If you want to read the full article it can be found at http://www.vanityfair.com/news/2015/01/china-worlds-largest-economy

Stiglitz warns that we need to be aware of the implications of this shift in power. Stiglitz calls it soft power. That is the influence the US has had on others with its ideas on economic and political life. With China becoming number one it will bring with it it’s own forms of soft power and in so doing will shine a harsh spotlight on the American model. Stiglitz claims the American model has not been performing for many in American society. The typical American family is worse off now than it was 25 years ago, adjusted for inflation, the proportion of people in poverty has increased. I wonder what the figures are for Australia?

Stiglitz comments that China too, is marked by high levels of inequality, but its economy has been doing some good for most of its people. China brought 500 million people out of poverty at the same time as the US entered a period of stagnation. An economic model that doesn’t serve the majority of the population is not going to provide a role model for others to emulate.

Professor Stiglitz also warns that if the US takes actions based on the idea that the world economy is a zero-sum game (Note: Zero-sum games are a specific example of constant sum games where the sum of each outcome is always zero. Such games are distributive, not integrative; the pie cannot be enlarged by good negotiation ( http://en.wikipedia.org/wiki/Zero-sum_game ) and adopts a policy that it needs to boost its share to reduce China’s — it will erode its soft power even further. This, Stiglitz claims, would be the wrong thing to do, ‘If we see China’s gains as coming at our expense, that would mean we would adopt a policy of containment, taking steps to limit China’s influence.’

It is here that I think Stiglitz has a view that we in Australia should take note of— he really asks a very important question along these lines: should we care that China has become the world’s No 1 economic power?

Stiglitz contends that on one level we shouldn’t care because the world economy is not a zero-sum game, where China’s growth must necessarily come at the expense of ours. In fact, its growth is complimentary to ours. ‘If it grows faster it will buy more of our goods and we will prosper.’

Stiglitz comments, ‘There has always been a little hype in such claims — just ask the workers who have lost their manufacturing jobs to China. But in reality that has as much to do with our own economic policies at home as it does with the rise of some other countries’. Stiglitz is commenting on America but his comments certainly apply to Australia.

On another level China becoming the worlds leading economy matters a great deal and we need to be aware of its implications as it seeks to influence the world with its own soft power, just as America did decades before.

The 1980s was when it all began. Reganomics, Thatcherism, under Hawke and Keating in Australia, who slavishly followed the economic philosophy and policies of America and the UK (soft power?) we got what was called in Australia, ‘Economic Rationalism’.

Economic rationalism was continued by the Howard government in the 1990s – broadly and without going into detail we were all persuaded by Hawke, Keating and Howard, that deregulation of financial institutions, floating the dollar, reduced taxation for high income earners, reduction and then almost elimination of tariffs and import restrictions, privatisation and business deregulation were all going to enhance economic efficiency, and our productivity and industrial competitiveness.

We now know it didn’t work. We exported Australia’s jobs in manufacturing without having anything to replace them. Governments sold off assets that belonged to the people to private enterprise and told us it would be good for us and time has shown it wasn’t, just look at rail services.

This is not a paper on the pros and cons of economic rationalism; suffice to say we now find ourselves on the cusp of a slowdown in our major national economic drivers, the resource industries. Our agriculture is confused as we have watched our food processing industry either close down or move off shore and at the same time our imports of processed food have increased.

Australian Bureau of Statistics (ABS) figures suggest that in the period from 2003–04 to 2009–10, the domestic market for food (including fresh food) grew by approximately 46.0%, while the processed food sector grew by only 32.2%. The sector does not appear to be keeping up with demand.

Meanwhile, imports of processed foods grew by approximately 62.0% during the period.

While Australia is a significant net exporter of processed food, it must be remembered that the beef, sugar, wine and dairy industries account for over 72.0% of all processed food exports. These industries accounted for around 38.0% of Industry Value Added (IVA) for the sector in 2010–11. http://www.aph.gov.au/About_Parliament/Parliamentary_Departments/Parliamentary_Library/pubs/BriefingBook44p/ProcessedFood

We must not be mislead, our food processing industry has been leaving the country in droves and those who claim it’s not as bad as some say, do not reveal that 72% of our processed food exports are in beef, sugar, wine and dairy.

All is not doom and gloom however, there is some Australian money coming back into Australian agriculture, or there are plans afoot for floats and other plans for money raising by Australian entrepreneurs, all, they say, to invest in Australian agriculture.

Sue Neales’ article from the recent ‘Global Food Forum’ sponsored by The Australian, The Wall Street Journal and Anthony Joseph Pratt. Chairman and CEO of Pratt Industries and Global Chairman of Visy Industries, the world’s largest privately owned paper and packaging company, tells us the world of agriculture in Australia is about to change.

Sue’s article claims that major investors now see Australian agriculture as being ‘cool’ (don’t you love it?) but I couldn’t help but notice, with maybe a couple of exceptions, the new ‘cool’ investments in Australian agriculture were in the processing business, not in farming, not in production where the risks are high and the margins small. Make up you own mind, don’t let me influence you, read the article at http://www.theaustralian.com.au/business/markets/agriculture-has-its-day-in-the-sun/story-e6frg916-1227251919519

The bright light is an ever-increasing worldwide demand for animal protein. The demand is there and it seems limitless, yet nobody is prepared to mention at what price. Some seem to be relying on the theory of supply and demand —the greater the demand the higher the price. I will be happier when long term contracts to supply meat are more than an expression of what the market wants. For the producer to invest in change there needs to be a price assurance. Too often producers have invested to produce only to find once they and their capital is committed to a venture the buyer(s) of the end product, to be kind, manipulate the market to their advantage.

Great change has taken place in the cereal growing industry since the 1960s. The world population has doubled yet the real value of cereals has declined and we have a rural debt to prove it. Many growing cereals are grossly overcapitalised for the returns they are achieving.

Stiglitz makes the point that after WWII there were two countries influencing the world with their soft power, America and the USSR representing two very different ways of how to govern and manage the economy of a country. Eventually the USSR failed and became something of a joke as far as soft power was concerned.

Stiglitz then claims that the US made two mistakes in the ensuing years. First and most importantly their narrow attitude and view, following the fall of the USSR that everything in the US was right and in many ways they ignored the needs of the developing world and their own Left — and the second mistake they made was in the narrow space between the fall of the Berlin Wall and the fall of Lehman Brothers, when the US pursued its economic interests, particularly those of its multinationals and banks — rather than to create a stable world order.

What is also fascinating is that Stiglitz demonstrates, that as China grew it showed that it wanted to take a larger role in existing international institutions; but the American Congress said in effect there was no room for new members; they, China, can take a backseat; and they can’t have voting rights commensurate with their global economic power. Among other things America insisted that an American should (continue to) head up the World Bank.

China had support from may powerful countries around the world and from the President of the United Nations regarding it’s ambitions to be accepted in the world order, particularly international financial institutions.

Stiglitz relates that China together with France and other countries — supported by an International Commission of Experts appointed by the President of the UN., formed a committee, which he, Stiglitz, chaired — which was asked to complete the work that Keynes had started at Bretton Woods, by creating an international reserve currency. The U.S. blocked the effort.

(The Bretton Woods Agreement was a landmark system for monetary and exchange rate management established in 1944. The Bretton Woods Agreement was developed at the United Nations Monetary and Financial Conference held in Bretton Woods, New Hampshire, from July 1 to July 22, 1944.

Major outcomes of the Bretton Woods conference included the formation of the International Monetary Fund and the International Bank for Reconstruction and Development and, most importantly, the proposed introduction of an adjustable pegged foreign exchange rate system. Currencies were pegged to gold and the IMF was given the authority to intervene when an imbalance of payments arose)

‘Markets can remain irrational longer than you can remain solvent’ J.M.K

The latest efforts of the U.S. Congress are to try and block Chinese investment in the Developing World where it is well know that trillions of dollars are needed for infrastructure and manufacturing, which are far beyond the capacity of the World Bank.

Stiglitz writes that China, working with many other countries in the region, is now trying to create the Asia Infrastructure Fund. Meanwhile the U.S. is twisting arms so that those countries won’t join.

Is Australia accepted as part of Asia?

With respect to Professor Stiglitz, I think he got the title of the fund that China is trying to set up wrong, it is not the Asia Infrastructure Fund because I can find reference to that back as far as 1994.

What China did on October 24 last year, 2014, was organise 21 Asian nations to sign up to be members of an Asian Infrastructure Investment Bank (AIIB), which China hopes to launch at the end of this year (2015) initially with funds of 8 billion. Noticeably absent from that meeting was Australia, South Korea and Indonesia.

It’s a fascinating story of China’s quest for economic dominance in Asia. America has been lobbying against the AIIB and it would be interesting to know if American influence initially kept Australia, South Korea and Indonesia, out of the AIIB?

The detractors of the AIIB claim that Asia already has a development bank, the Asia Development Bank (ADB) and of course there is always the World Bank, so why, they ask, start up another bank? China’s answer is that neither the ADB nor the World Bank can meet the needs of Asia in the foreseeable future.

Within the last couple of days, as I have been writing, it has been announced that both the UK and NZ are well advanced with their applications to join the AIIB and according to China they will be welcomed into the organisation. The UK it is reported will become a founding member. Australia was invited last year to become a founding member, but declined after talks with America and expressing some concerns over AIIB governance.

On March 13 2015 Australian Treasurer Joe Hockey is reported to have said, ‘This (AIIB) is something that will obviously be taken into account by the government over the next few weeks as we continue our dialogue with those people behind the bank.’ In the last few days, March 16, Julie Bishop, Minister for Foreign Affairs, has indicated Australia’s increasing interest in the AIIB and that many of the reservations Australia has had have been overcome. On March 16 the Prime Minister, Tony Abbott said Australia would make up it’s mind (on the AIIB) within a week.

It’s a pity Australia is a follower and not a leader, a founder of the AIIB. Is this yet another another example of our obsession with navel gazing, lack of knowledge of geography and our internal factional and party political point scoring while the world moves on without us? We are part of Asia no matter how much the Anglophiles and the Americans try to persuade us otherwise. Asia is determined to develop, with or without us, what it sees as its rightful place in the world. Whether we should or should not be part of the AIIB is really a ‘no brainer’. That raises serious questions about brains.

Has the influence even pressure of American soft power, made us slow to become active in the AIIB and are we now faced with the very real decision as to whether to stand on our own two feet and pay more attention to the hands that feed us in China, Korea and other parts of Asia, rather than the soft power of America?

Perhaps we should take a leaf out of Britain’s book? Britain no longer has Hong Kong as the last remnant of the British Empire in Asia, but it would be wrong to assume that Britain has lost interest or influence in that part of the world and as we shall see, also in Australia. New Zealand of course, at Australia’s cost, has an FTA with China and once again New Zealand, a nation devoid of natural resources, with agriculture and tourism its two biggest industries, is showing us you don’t have to have the biggest mine in the world, or the biggest gas field, to be a player in the ‘Asian Century’.

It is unlikely that Australia’s FTA with China will affect the import of Chinese foodstuffs into Australia via New Zealand, It’s cheaper to run a food processing factory, or any kind of factory in New Zealand than it is in Australia. One wonders where growth and jobs will come from, when we seem to have priced ourselves out of so many markets.

It has also been suggested that China is more than a little exasperated at the control of Japan and America in Asia and it wishes to redress this imbalance —and now as the biggest economy in the world, China is seeking what it sees as its rightful position of influence in Asia and at the same time competing with America and America’s close ally Japan, for the Asian dollar. There is a fascinating article in The Economist at: http://www.economist.com/blogs/economist-explains/2014/11/economist-explains-6

China and Australia.

Australian agriculture has to consider, ruminate perhaps and come to a decision about China and China’s soft power. Do we want it or don’t we? It’s a big decision and could well affect the future of this country and it’s agriculture in an increasingly uncertain world.

Or has the decision already been made? Has China quietly without any fuss and with the willing cooperation of Australian traders in all manner of goods from hardware and mass market clothing, to desirable labels, and a thousand and one other things applied sufficient soft power to the Australian economy that it would be hard to imagine life without them? Are Target ® and Bunnings ® and many more similar businesses now integral to life in Australia? Could we manage without them? ‘Made in China ‘ is now synonymous with so much of Australian life. Could China be replaced?

The other thing that China has done, largely without any fuss, it has built a network of high speed rail, superhighways and even new cities and in so doing it has shown the world that it has the capability and the technology to do the same for others.

When the USSR failed and America became number one many of her soft power efforts were put into shoring up a diplomatic defence against what it saw as the next big threat, China. China, on the other hand, went about it’s business around the world without any outward concerns for what America might think or do. It almost seemed that China’s public image, what it wanted to convey to the world, was that it didn’t care about America.

It looks like it has paid off.

Agriculture

In agriculture an example of the absolute power of American soft power is how we have become almost completely dependent on American agricultural machinery. We have let our agricultural machinery industry die. Not very long ago it was one one of the most innovative and inventive in the world, which employed a lot of people. Now nearly every machine from the farm 4wd to seeding and harvesting machinery is imported.

The premiums charged for genetically modified seed, again controlled by America, are not an example of soft power —just power! Whether they are worth the premium the market will decide as the hype cools. Whether we want our (GM) future controlled by a few, maybe one very powerful company is worthy of serious debate. We proceed as if nobody cares. America pushes on and are determined to control the global genetically modified seed industry. We seem to be the dog on the lead. Where they go we go.

A large proportion of our food processing industry has moved off shore, a substantial part to New Zealand where apparently it is simply cheaper to run a factory. New Zealand, because of its FTA with China, has become the clearing house for Chinese food into Australia. What we exported we now import. For all the details and an eye opening read: http://www.agriculture.gov.au/SiteCollectionDocuments/ag-food/publications/food-stats/australian-food-statistics-2012-13.pdf

The Boom is Over —Now we have to pay for it.

Everyone agrees the resource boom is over. No matter where one looks whether it’s at a State budget or the Australian government’s so-called national budget, the word for this decade and beyond looks like being ‘austerity’.

As prices have fallen for resources so royalties to State governments have declined. Commitments were made in the good times, now savings have to be made in the not so good times.

Miranda Stewart, Professor and Director, Tax and Transfer Policy Institute, Crawford School of Public Policy at Australian National University, writes in ‘The Conversation’ of 15 February and tells the story of how this country is spending $100 million a day more than it is collecting and in addition paying $40 million a day in interest on money borrowed. Prof Stewart says we will have to accept higher taxes.https://theconversation.com/factcheck-is-australia-spending-over-100m-a-day-more-than-collected-in-revenue-37172

It is hard to make a case that we as a country have been good managers of what has been the biggest boom in our history when we have a $140 million a day shortfall of income over expenditure. Why isn’t there bi-partisan agreement on this parlous state of affairs?

As if that isn’t enough it has just been announced that Australia has the highest household debt of any country in the world and we are sitting on a ticking bomb and exposing our economy to another financial crisis. Barclay’s Bank Kieran Davies reports that Australian household debt is equal to 130% of Gross Domestic Product (GDP) this compares to an average of 78% average across the advanced world. http://www.smh.com.au/business/the-economy/australian-households-awash-with-debt-barclays-20150316-1lzyz4.html

Household debt was 116% of GDP before the global financial crisis and held steady until the property boom set it rising again. Apparently Australia’s debt levels are rising as those in other countries are falling. It is predicted any rate cuts will push borrowing even higher.

How important is China to Australia?

According to the KPMG — Sydney University report, very important. They tell us why in their report:

Demystifying Chinese Investment in Australia 2014.

http://demystifyingchina.com.au/reports/Demystifying-Chinese-Investment-Survey.pdf

Despite investing over USD60 billion directly into Australia in the period between 2007 and 2013, Chinese companies are still relatively new investors in Australia, which is a highly regulated developed economy fundamentally different to their home market and other developing countries. As such, their level of experience is still quite low relative to American, British, Japanese and Korean investors who have at least a 20 to 30 year head start.

One of the conclusions in the report is:

Chinese investors are optimistic about the future of their business prospects in Australia. They see investment in Australia as part of their globalisation strategies and not as an isolated market. What they learn in Australia, they will apply to other markets and vice versa.

They feel that they are welcome in Australia and that Australia is a safe place to invest.

However, they are concerned about negative media coverage. Australian governments and business leaders are seen as supportive, but the investment approval process is seen intrusive and costly while recent improvements are acknowledged. Chinese investors feel their operations are constrained by Australia’s physical infrastructure.

As a nation, apart from a few ill informed xenophobic people in agriculture I cannot recall one objection from any section of the community, as China has invested US$60 billion in Australia in the last six or seven years. Give or take a few dollars that is US$10 billion a year. But as you will see, that figure of $60 billion is only 7% of the total amount that was invested in Australia between 2005-6 and 2011-12

Foreign Investment in Australian Agriculture

There are those who believe foreign entities even Sovereign Funds, have found ways of getting round the Foreign Investment Review Board (FIRB). The Minister for Agriculture, Barnaby Joyce has promised that the ATO are going to do a ‘stock take’ of foreign owned land but we will have to wait until July before they start the process.

The Prime minister recently announced that the FIRB threshold will be reduced from A$252 million to A$15 million and to be applied to cumulative purchases. The reductions do not apply to the United States or New Zealand they virtually have open slather. Is the soft power or the real power of America expressing itself? China is unhappy with the new threshold and believes it should have the same concessions as America and New Zealand. That is an understandable position considering the importance of China to the Australian economy. Why restrict China? What is the difference between Chinese money and American or New Zealand money?

So all we have to go on at present to get a historical perspective on purchases of Australian agricultural land is a report in the Parliamentary Library, Foreign investment in Australian agriculture by Kali Sanyal. Economics. 2014. www.aph.gov.au/About_Parliament/Parliamentary…/ForeignInvest

The data in this report only goes back to 2005-6 to 2011-2012. The total overseas investment in agriculture over the five years was $12.6 billion, just 1.94% of the total foreign investment in Australia of $844.7. billion. Those numbers do not include food processing or agribusiness. Some doubt Australia needs foreign investment, $844.7 billion says that is not true. Whoever would have thought that investment in agriculture is just about 2% of that figure.

The biggest investor in Australian land was Canada with $3.1 billion followed by the United Kingdom with $2.7 billion. The USA invested $1.5 billion. They were the three big ones. Many other countries have invested from $500 million down to Hong Kong at $48 million and China at $31 million. China according to the FIRB started investing in 2010-2011.

Maybe a lot has changed since 2012. Maybe many foreign investments (Chinese and Indonesian some say) have slid under the radar by forming or using Australian companies. It is to be hoped that the ATO when they have completed their investigation come under the same scrutiny as the FIRB have of late.

As we move towards 9 billion people to feed in 2050

Maybe in the last couple of years China has increased its investment in Australia. There is no denying that China is now ‘the’ major economic force in the world. There are comments and speculation in many financial journals and columns in newspapers questioning whether China can maintain the growth figures it has set for itself, now I believe down from 7.5% to 7.0%. There is talk of inflation in China and major moves being made to rein in local government spending and renegotiate their loans making repayments over a longer period.

As China’s growth predictions are being questioned, the numbers have started to improve in America. Productivity is up and unemployment is down, one commentator the other day predicted America would not lose their number one spot. He obviously hadn’t read the World Bank Comparison Report. Is America fighting back?

I believe the difference between China and the other countries that have, and presumably will continue to invest in Australian agriculture, is that the investors from other countries see an opportunity to buy ‘cheap’ Australian land. Any surplus production they may have to their own repatriation requirements, they know they can export to China and Asia.

China on the other hand is buying Australian land, and land in other countries where ever it can, because it needs more land to feed what will be a third of the world’s population by 2025.

In addition to buying land, China hasn’t made any secret that it wants to buy animal protein from ‘safe’ countries, that is countries that don’t have major disease problems like foot and mouth. In the next ‘Global Farmer’ we will look at the aggressive moves China have been making not just Australia but all over the world to secure food supplies for the future.

Has the land grab started as a precursor to the promised ‘Food Wars’ as the population of the world creeps towards nine billion?

This is a well researched article Roger and I feel that I can add some meat to the bones of your arguments.

#Hot new fact -China has used more cement in the last 3 years than the US did in the last 100 years.It is nearly a year since I was there and it is an amazing place

# Australia will have to get a lot smarter if it is going to allow it’s companies to benefit out of this juggernaut.

# Foreign Investment is great -so long as it is a two way street. Due to weak lazy policy – it is far from that at present.

# I took a prospectus up for a Joint venture partner to look at re exporting restaurant beef. There were only two abattoirs that were doing “custom kill” then to enable one to retain meat ownership -I got the tick to do a container of frozen boxed beef a week from the Casino coop. With the export licences and all the restrictions acting as a barrier to this supply method – it means that the four large multinationals have ALL or about 95% stitched up between them.

I costed out every stage obviously and the Feeder steer( 4-500kg angus) was selling for $1.70-$1.80 tops then . Feedlots were chockers and grain prices and drought had the “custom Feed” – fed out rate @ a record $400 per tonne fedout. Being a producer of 40 years I did my buy in budget @ $2.50/kg live- a price that I thought we would have seen in spring last year and a price that was a minimum without insulting the breeders. The up to date quote @ Casino was factored in with transport to port of Brisbane and reefer to the three main ports in China. For supervising all this at every stage – my little team added a fee based on delivered meat in the container by weight. This was a modest amount but would have grossed much more than my efforts as a cattle breeder and I felt I could have delivered a top 110 day grainfed product -fully boned out to the JV partners specs. delivered to the port of choice.

This would have been funded -100% cost plus by the importers and collateral would be the NLIS tagged cattle that I would have bought. The Investors tagged cattle would all be listed at the feedlots PIC then the Works pick and they would have complete info on every animal- feedlot performance-kill performance and the whole animal would end up for their distribution network.

So people that aren’t in this game – consider that Chinese money has benefited our breeders with a fair price, our feedlotter with a fair price, our Co-op Abattoir with a fair kill bone and box price and a little aussie group who are really just agents or jv partners- with fair reward.In other words – good news for Australians and Australia.

It is also very good business for the importer as they would have total control over frequency, quality (ie maybe they might want 150 days on grain for a higher cost base- the choice would be theirs. Mortality is less than 1% and everything would be totally transparent at every stage and digital technology could have daily inspections if anyone requested.

I believe that China is trying to secure their future protein supplies and don’t really want to buy land. They buy the land because our agents push it at them for the commissions. If they buy land and then they buy the meat works – then they are cooking with gas as Vertical Integration happens then! They bought Kilcoy meatworks a year ago and recently the Ipswich works.

The WORKS are the key to the spoils.

Apart from the AAco who just built a new one near Darwin- all the processing is divided up between 6 mega co’s that cover both domestic and export. I can tell the reader here now because we failed to get the JV partner at the time and the drought overtook my priorities here…………………It is a FULLHOUSE at Casino and the other little joint. People are knocking the door down to try what I wanted to do. This is the unspoken and unwritten about CHOKE point that is leaving the multinational cartels to have all the cream. For the Govt to be crowing about these FTA being good for farmgate and producers is a double insult because a fuller order book just means MORE transferred mega profits to the mother country and the lack of competition means the misery continues for aussie livestock producers at less than half what the US,EU and most of Asias breeders are getting.

Of course our supermarket duopoly get a free ride here on the back of the export strangulation and the average supermaket retail @ meatcounters in 2014 was $16.28/kg.For most of that year they were paying us $1.80 for the whole prime animal……….hence their record profits as all food supplies cop the same jackboot treatment.

Since the door has shut on my little venture- I can tell you folks that I could land the meat there for $10 aussie /kg. Last time I looked the average port price was over $11 which becomes the same wholesale price for some very generic animals in the average. So one can see that my plan was top notch grainfed restaurant meat for less than that and it would be easily twice the quality of the average imports for them………………..

Like Ned Kelly said -“Such is life”